A Profit and Loss Statement (P&L) is one of the most essential tools for evaluating the financial performance of your business. This document shows the company's operating results over a specific period, highlighting both the revenue earned and expenses incurred.

It not only provides insight into a company’s profit or loss but also helps entrepreneurs make better financial decisions.

A Profit and Loss Statement (P&L), also known as an income statement, is a financial document that summarizes all revenues and costs related to a business over a certain period.

This statement is crucial for determining whether a business is making a profit or loss, while also assisting in future financial planning.

A Profit and Loss Statement serves multiple purposes, helping business owners and entrepreneurs:

It provides an overview of whether a business is generating profit or incurring losses.

Business owners can plan investments, control costs, and strategize for the future based on this information.

The P&L statement demonstrates a business's ability to generate profit, instilling confidence in investors and financial institutions.

The Profit and Loss Statement consists of several key components:

Revenue is the total earnings from sales or services provided by the business within a specified period. This is a critical figure that reflects market strength and operational efficiency.

COGS refers to direct expenses related to producing goods or services. This includes material costs, labor, and manufacturing expenses.

Gross profit is the difference between revenue and COGS, showing the profit margin after production costs.

These include both fixed and variable costs such as rent, employee salaries, and utilities. Operating expenses indicate the daily running costs of a business.

Net profit is the final result after deducting all expenses from revenue. It is the primary indicator of whether a business is making a profit or loss.

Understanding a P&L statement requires a deep understanding of each component. Here’s how to interpret the document effectively:

Gross profit shows how much production costs affect sales. If the margin is too small, it could mean production costs are too high.

Analyze fixed and variable expenses to identify areas where costs can be reduced without affecting operations.

If net profit is low or negative, it may indicate the need for changes in business strategy or tighter cost management.

There are several common mistakes when preparing a P&L statement:

Small costs like stationery or transaction fees may seem trivial but can have a significant impact on net profit when combined.

Recording revenue that hasn’t been received yet can give an inaccurate picture of a business’s financial health.

Incorrectly grouping operating expenses under COGS can make a business appear more profitable than it actually is.

In addition to the P&L statement, two other financial reports are essential for assessing a business’s financial health:

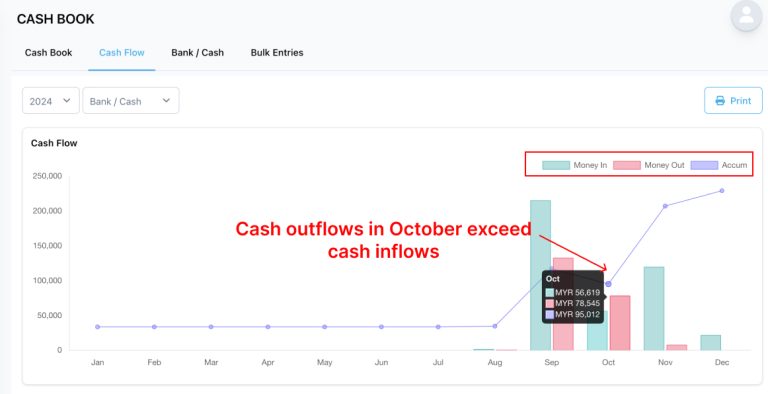

This report tracks the inflow and outflow of cash over a specific period. It helps business owners understand their actual cash flow and ensures business liquidity.

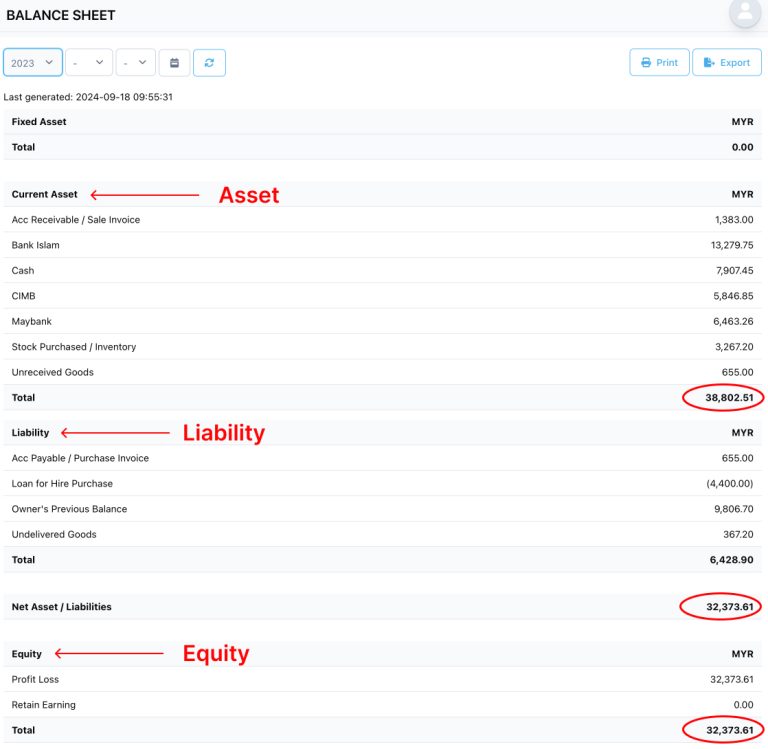

A balance sheet shows a business's assets, liabilities, and equity at a particular point in time. It helps business owners understand the overall financial position, including what the business owns and owes.

To manually prepare a Profit and Loss Statement, follow these steps:

Collect all income-related data within a period. For example:

Product Sales: RM10,000

Service Sales: RM5,000

Total Income: RM15,000

Note all costs associated with producing goods or services. For example:

Material Costs: RM3,000

Labor: RM1,000

Total COGS: RM4,000

Use the formula:

Gross Profit = Income - COGS

RM15,000 - RM4,000 = RM11,000

Include all indirect expenses, such as:

Rent: RM1,500

Utilities: RM300

Total Expenses: RM1,800

Use the formula:

Net Profit = Gross Profit - Operating Expenses

RM11,000 - RM1,800 = RM9,200

Manually creating a P&L statement can be time-consuming and requires precision. Here's how NiagaPlus simplifies this process:

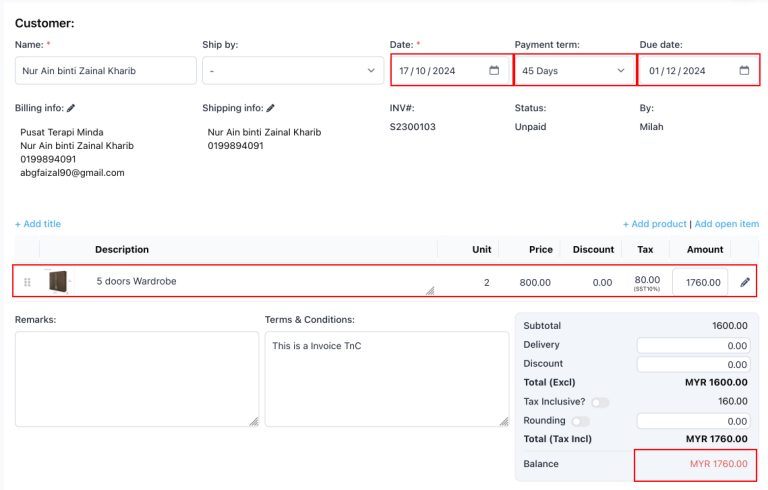

With NiagaPlus, simply enter your income details, and the system automatically calculates the total revenue.

Input your related costs, and NiagaPlus will automatically calculate the total cost of goods sold.

Based on the data entered, NiagaPlus calculates gross profit instantly.

Enter all your operating expenses, and the system will tally them for you.

After entering all the necessary information, NiagaPlus allows you to generate a complete P&L statement with just a few clicks, saving time and ensuring accuracy.

A Profit and Loss Statement is a crucial financial management tool for businesses. By following the steps above, you can manually prepare this statement. However, using a system like NiagaPlus makes the process faster and more efficient. Not only does it save time, but it also ensures accuracy in your financial reporting, enabling you to focus more on growing your business.