Introduction

Running a business in Malaysia can be exciting, but nothing dampens that excitement faster than tax confusion, especially when it comes to SST (Sales and Service Tax). If you're running a business here in Malaysia, whether you're selling awesome local products or providing top-notch services, getting a handle on Malaysian SST is definitely something you need to do, especially looking ahead to SST 2025.

While taxes and compliance may seem complex at first, gaining clarity on SST is more than just a regulatory requirement.

But trust me, understanding SST isn't just about ticking boxes for the government; it's actually crucial for keeping your business healthy, compliant, and ready for growth as we navigate 2025.

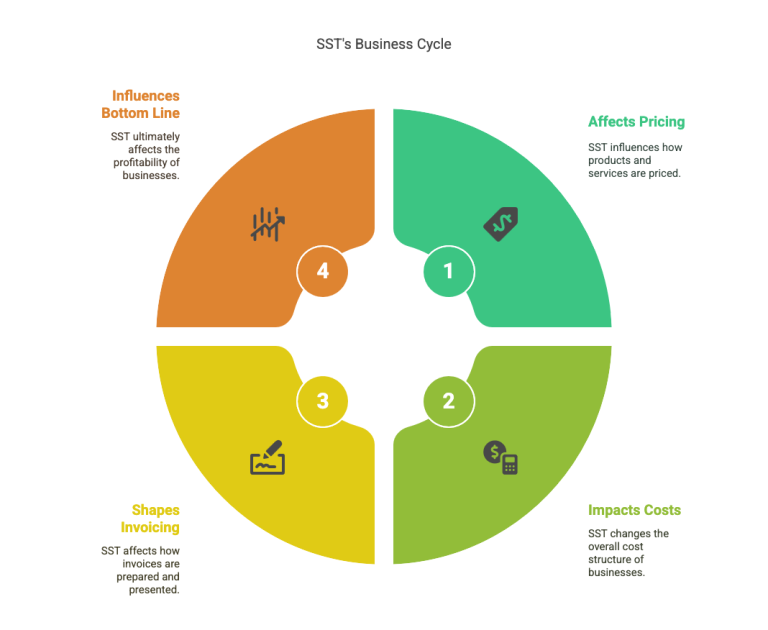

Think of it this way: SST is part of the everyday fabric of doing business here. It touches your pricing, your costs, how you invoice your customers, and ultimately, your bottom line.

Misunderstanding or neglecting SST obligations can lead to unnecessary complications, including potential penalties and financial strain. However, with a solid understanding of SST, you’ll be able to run your business more efficiently, plan ahead with greater accuracy, and make decisions with confidence.

You don’t need to become a tax expert overnight. What you do need is a clear, reliable guide to help you navigate SST requirements effectively. That’s what this article is here to provide—so you can focus on growing your business while staying informed and compliant.

Why Understanding SST is Crucial for Your Business Growth in 2025

So, why the big fuss about SST, especially now in SST 2025? Firstly, the rules and the SST rate can change. Remember the shift in the service tax rate back in March 2024? Staying updated ensures you're charging the right amount and paying the correct tax to the Royal Malaysian Customs Department (RMCD). Getting this wrong can mean either overcharging your customers (not great for building loyalty!) or underpaying your taxes (definitely not great for avoiding trouble!).

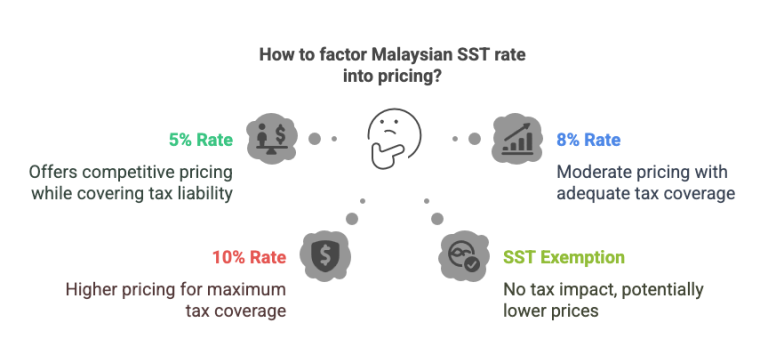

Secondly, proper SST management is fundamental to good financial health. It impacts your cash flow – you collect SST from customers, hold onto it for a bit, and then remit it to the government. Knowing your obligations helps you manage this flow effectively. It also affects your pricing strategy. How do you factor the Malaysian SST rate into your prices competitively while ensuring you cover your tax liability? Understanding the different rates (5%, 8%, 10%, or even SST exemptions) is key.

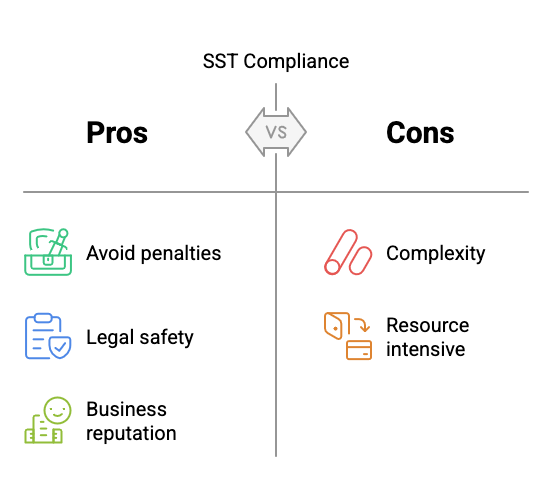

Furthermore, being SST compliant builds trust and credibility. When your invoices are correct, your SST filing is on time, and your records are in order, it shows professionalism to your customers, suppliers, and even potential investors or lenders. It signals that you run a tight ship. Plus, let's be honest, avoiding those hefty penalties for non-compliance (which can range from fines up to RM50,000 or even imprisonment in serious cases) is a pretty big motivator for maintaining good SST compliance!

Finally, as Malaysia continues its digital push, understanding how SST integrates with modern business tools, like accounting software, is becoming increasingly important. Tools like Niagawan are designed specifically to help Malaysian SMEs like us handle SST calculations, generate compliant invoices, and prepare for SST return filing much more easily. Getting SST right frees up your time and mental energy to focus on what you do best – growing your amazing business.

Who This Guide Is For

This SST guide is designed to support a wide range of business owners and professionals in Malaysia, whether you're just starting out or already established. It’s especially useful for:

1. Small business owners unsure about SST registration

2. Freelancers or service providers nearing the RM500k threshold

3. New importers and manufacturers

4. Any SME struggling with SST compliance in 2024

How This Guide Makes Malaysian SST Compliance Less Scary (and Supports Your Accounting!)

We understand—terms like “taxable period,” “SST-02 form,” “MySST portal,” and “SST registration threshold” can feel overwhelming, especially when you're focused on running your business day to day. This guide is here to simplify things. We've broken down Malaysia’s SST system into clear, straightforward language, tailored specifically for SME owners preparing for SST 2025.

Think of this as your practical, step-by-step roadmap to understanding Sales and Service Tax in Malaysia. Here’s what we’ll cover:

1. The Basics: What SST is, the difference between Sales Tax and Service Tax, and who it applies to

2. SST Registration: How to determine if you need to register—especially if you're nearing the RM500,000 threshold—and how to register through the MySST portal

3. SST Filing: Demystifying the SST-02 form and the process for submitting your returns and payments bi-monthly.

4. SST Compliance: A simple checklist for keeping good records, issuing proper invoices, and avoiding common pitfalls.

5. Pricing: Smart ways to handle the SST rate in your pricing strategy.

Our aim is not just to provide information, but to make it useful, relatable, and easy to apply. Throughout the guide, we’ll share practical examples relevant to Malaysian SMEs and show how good accounting practices—and the right tools—can make SST compliance far less stressful.

Consider this your go-to reference for navigating SST in 2025. Let’s get started.

Section 1: What Exactly is SST in Malaysia? (The Basics for Busy Business Owners)

Let’s break down the basics of SST in Malaysia—clearly and without the jargon. At its core, the Sales and Service Tax (SST) is not a single tax, but a combination of two separate taxes:

Decoding SST: Sales Tax vs. Service Tax Explained Simply

1. Sales Tax: This tax applies to taxable goods that are either manufactured in Malaysia or imported into the country. It’s a single-stage tax, meaning it is charged only once—typically at the point when the manufacturer sells the goods or when the goods are imported.

Good news if you export stuff you made – those are typically exempt from Sales Tax.Now, the SST rate for Sales Tax isn't one-size-fits-all. It can be 5% for certain things (like some food items, building materials, IT gear) or the standard 10% for many others. Some specific items might have unique rates, and importantly, lots of essential goods get a pass altogether (we'll chat more about SST exemptions later).

2. Service Tax:This one's for services. It's applies to prescribed taxable services offered by registered businesses within Malaysia. Like Sales Tax, it’s also a single-stage tax, applied at the point when the service is provided to the customer.

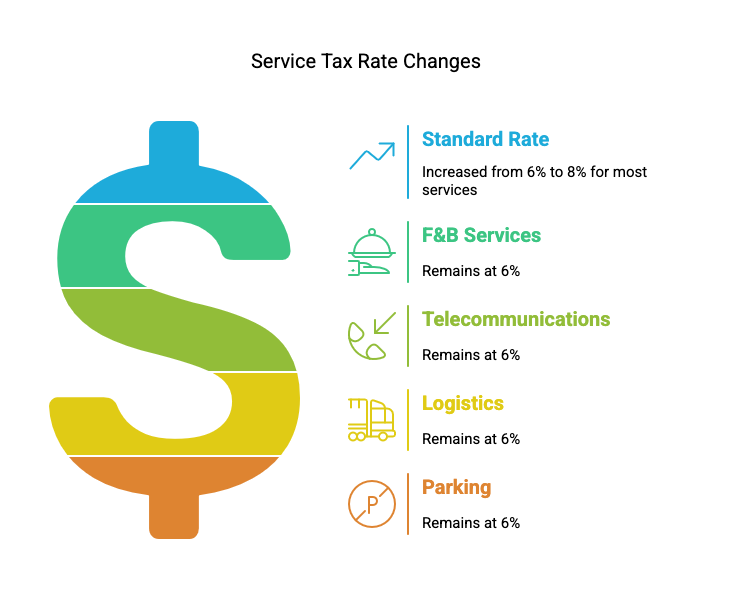

As of March 1, 2024, the standard Service Tax rate increased from 6% to 8% for most taxable services. But don't panic, some essential sectors—such as food and beverage (F&B) services, telecommunications, logistics, and parking—remain at the lower 6% rate.

Imported or exported services are generally not subject to Service Tax, though special rules apply to imported digital services purchased by Malaysian consumers.

In short:

Sales Tax = Goods (manufacturing or importing)

Service Tax = Services (specific local offerings by registered businesses)

Knowing which one applies to your business is key to understanding your obligations under SST.

Who Collects and Who Pays SST? (Hint: It's a Consumption Tax)

This part can be confusing at first, but once you understand the principle, it’s quite straightforward.

SST is what’s known as a consumption tax. That means the end consumer—the person buying the product or using the service—is the one who ultimately bears the cost of the tax.

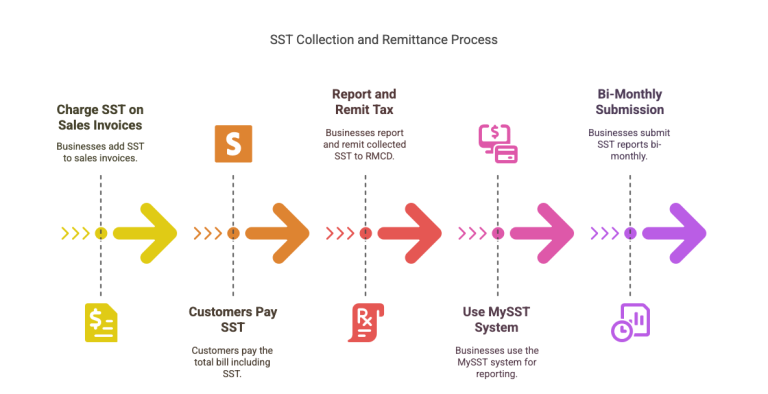

However, as a registered business, you act as the collection agent on behalf of the government. Here’s how it works:

- You charge SST (either Sales Tax or Service Tax, depending on your business type) on your sales invoices.

- Your customers pay this tax as part of their total bill.

- You then report and remit the tax you’ve collected to the Royal Malaysian Customs Department (RMCD) via the MySST system, usually on a bi-monthly basis.

In simple terms: the customer pays the tax, you collect and pass it on to Customs.

It’s important to remember that failing to report or submit the correct amount can lead to penalties—so staying on top of this process is crucial for compliance.

Key Differences: SST vs. the Old GST in Malaysia

Many business owners still recall the GST (Goods and Services Tax) era from 2015 to 2018. While both GST and SST are consumption taxes, they operate quite differently—and it’s important to understand how those differences affect your business today.

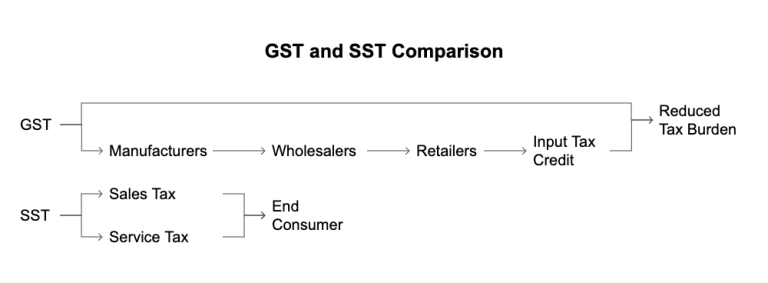

The Core Difference: Multi-Stage vs. Single-Stage

GST was a multi-stage tax. It applied at each step in the supply chain—from manufacturers to wholesalers to retailers. However, businesses could claim back the GST they paid on their own purchases (known as input tax credit), which helped reduce tax burden across the supply chain.

SST, on the other hand, is mostly single-stage. Sales Tax is typically applied once, at the manufacturer or importer level, and Service Tax is charged only when the service is delivered to the end consumer.

What Does This Mean for Your Business?

Under SST, you generally cannot claim back the SST you pay on your business inputs or purchases. This makes SST simpler to manage, as there’s no input-output tax tracking like in GST.

However, it also means that your cost structure may be more directly affected, especially if you frequently purchase SST-taxable items for business use.

People also often point out that SST tends to cover fewer goods and services compared to GST. This means that some items that were taxable under GST may now be exempt under SST, potentially lowering the tax burden for some sectors.

Why Staying Updated on SST Matters for Your SME's Bottom Line

SST regulations in Malaysia are not set in stone. As we saw with the Service Tax rate increase in 2024,, the government can adjust rates, update thresholds, or revise the list of taxable and exempt items. That’s why it’s essential for SMEs to stay informed as we head into SST Malaysia 2025.

Here’s why it matters:

- Accurate Pricing : Using outdated SST rates or exemptions could mean you're charging incorrectly—either overpricing and turning customers away, or underpricing and absorbing the tax cost yourself when it’s time to pay Customs.

- Compliance Made Easier: Keeping up with the latest SST rules, such as filing deadlines, required invoice details, and registration changes, helps you avoid penalties or unexpected audits from RMCD.

- Better Financial Planning: When you clearly understand your SST obligations, it becomes easier to manage cash flow, set aside tax payments, and plan your finances without surprises.

- Identifying Opportunities:

Occasionally, regulatory changes come with new exemptions, special schemes, or transitional reliefs that could benefit your business—if you’re aware of them in time.

To keep your business compliant and competitive, make it a habit to check updates via the MySST portal and trusted financial news sources. With the basics of Malaysia’s Sales and Service Tax now covered, let’s move on to the next step: figuring out if your business needs to register for SST.

Section 2: Does Your Business Need to Register for SST?

This is important for your business. Let’s figure out together if your business needs to sign up for SST registration.

SST Registration Threshold

First, you may need to understand the SST Registration Threshold. The main thing that triggers mandatory SST registration is your taxable turnover. For most businesses dealing with Sales and Service Tax Malaysia, the general SST registration threshold set by the forks at the Royal Malaysian Customs Department (JKDM) is RM500,000.

How does it work?

You need to look at these in a 12 month period:

Total value of your taxable goods sold (for sales tax),

Taxable services provided (for service tax)

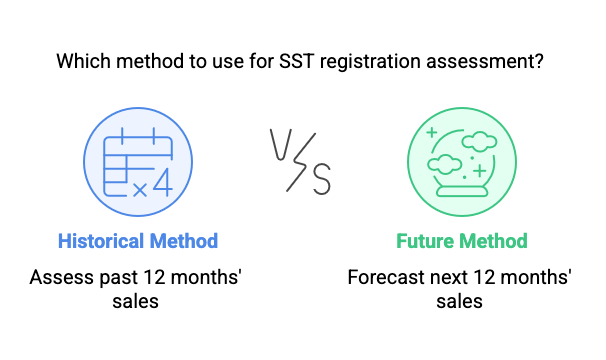

There are 2 ways you might hit this SST registration threshold:

1. Historical Method: looking back at your sales for the past 11 months and this current month. If your total taxable turnover during those 12 months was RM500,000, then yes, you are liable to register for SST.

2. Future Method: If you have solid reasons to believe your taxable turnover in the current and next 11 months will go above RM500,000 (maybe you just deal with a big contract with a big client), then you are also liable to register for SST.

Once you cross this threshold, don’t delay! You are required to apply for SST registration by the last day of the next month after you became liable. For example, if your business’s sales crossed the limit of RM500,000 in May, you are required to register SST by the end of June.

But for the F&B business, whatever restaurant, cafe, bar, canteen, food court, etc, the SST registration threshold for Service Tax is set at RM1,500,000 annual sales.

Who is required to register for SST?

For Sales Tax: Generally, you’re SST liable if you manufacture taxable goods in Malaysia and your sales value of those goods goes over the threshold, including importers (effective 2019).

For Service Tax: Generally, you are SST liable if your business provides taxable services in Malaysia. The value of those services goes over the relevant threshold, currently RM500k or RM1.5m for F&B).

It’s really crucial to know for sure if the goods/services you are selling or providing are actually classified as taxable under the current SST legislation. JKDM has a list and guides to help you figure this out.

What if business turnover is chilling below the RM500,000 SST registration threshold?

In most cases, you don't have to register for SST. However, the rules do allow for voluntary SST registration, but you still need approval from the JKDM.

Why would anyone choose to do voluntary SST registration?

For B2B businesses, they can be dealing with big clients. If your main clients are already SST-registered businesses, they might prefer suppliers who are also registered. It can make your business look more established.

For a specific case like manufacturers, being registered might let them access certain facilities or exemptions when buying raw materials, potentially lowering costs.

But voluntary SST registration is a big decision. You are required to take on all the duties like charging SST, doing SST filing, keeping detailed records, etc. Think carefully about your business model and who your customers are best for advice.

Okay, hopefully you have got a clearer picture now of whether SST registration is on your to-do list. If it is, let’s move on to the actual step for getting it done via the MySST portal.

Section 3: Your Step-by-Step Guide to SST Registration via MySST

So, you’ve determined that your business needs to register for SST—great first step. Take a deep breath and don’t worry. The good news is that SST registration in Malaysia is fully online, handled through the official MySST portal by the Royal Malaysian Customs Department (RMCD). No need to visit a government office—you can complete everything from your desk.

Getting Started: Navigating the Official MySST Portal

First things first, point your browser to the official MySST website . Go ahead and bookmark it – you’ll be using it regularly for things like SST registration, bi-monthly filings (SST-02), and tax payments.

Take a quick look around the site. You'll spot options like Login, SST Registration Status, New SST Registration, Legislation & Guides, etc. Since you're registering for the first time, you'll want to focus on the "New Registration" section.

Important Note: If your business was already registered during the GST era (2015–2018), the Royal Malaysian Customs Department (RMCD) may have automatically transferred your details and registered you for SST back in 2018. You should have received an email about it at the time.

Before you start a new application, check your SST registration status on the MySST portal using either your old GST number or Business Registration Number (BRN) under the "Registration Status" section.

Better to check now than deal with duplicate records later!

The Online SST Registration Process:

Assuming you're starting fresh with SST Malaysia, here’s the typical flow you’ll go through:

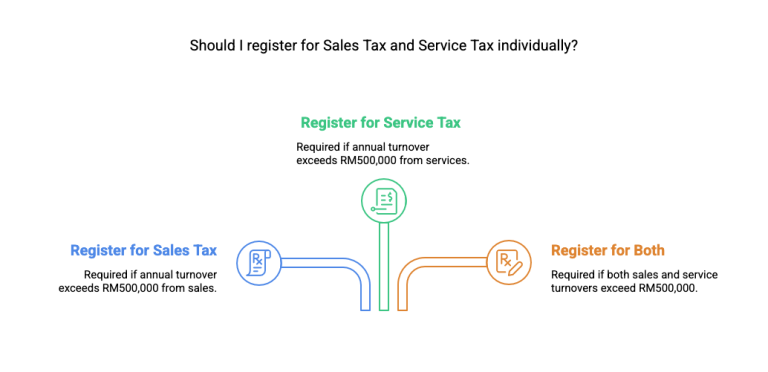

Step 1. Start New Registration: Choose the Right Tax Type

On the MySST portal homepage, click the "New Registration" button to begin. At this stage, you'll need to choose:

- Sales Tax Registration,

- Service Tax Registration,

- Or Both — if your business is involved in manufacturing/importing and providing taxable services.

Important Reminder: Sales Tax and Service Tax are treated as separate registrations, even though they're managed in the same MySST system.

So if you qualify for both based on your business activities and hit both RM500,000 annual turnover thresholds, you'll need to apply for each one individually.

Step 2: Fill Up the Online Form

Once you've selected the right SST registration type, the system will walk you through the online form. It’s pretty straightforward, but make sure you have these details ready:

- Business Information:

Your business name (as per SSM), SSM registration number, business address, and contact info.

- Nature of Business:

Explain clearly what your business does — whether you manufacture taxable goods, provide specific taxable services, or both.

- Turnover Figures:

You’ll need to provide your business's annual sales turnover to prove you meet the RM500,000 threshold for SST registration.

- Bank Account Details:

Add your business bank account info (this will be linked to your SST profile for refund purposes, if relevant).

- Key Person-in-Charge:

Enter details for the person managing SST matters — usually a business owner, director, or finance manager. Their name, IC/passport number, designation, and contact info will be required.

Step 3: Upload Supporting Documents:

Once you’ve filled in your SST registration details, the system will prompt you to upload scanned copies of key documents to support your application. (More details below).

Step 4: Check and Submit:

Read through everything carefully – maybe ask a colleague to check too? Accuracy is super important for SST registration! Once you're happy, hit that submit button electronically via the MySST portal.

Step 5: Confirmation Received!:

Based on what others have shared (like AJobThing and ClearTax), once you successfully submit your SST registration application, you might get an instant notification, maybe even your SST registration number and effective date straight away. An official approval letter usually follows via email too.

If you’re unsure about any part of the SST registration process, the Royal Malaysian Customs Department (RMCD) has you covered. On the MySST portal, under the “System Guides” section, you’ll find official user manuals and even step-by-step video tutorials.

These resources are especially useful for first-time applicants, as they walk you through exactly what to click, where to enter your details, and how to upload your documents properly.

Documents Needed for SST Registration: Get Your Files Ready!

Even though the MySST portal makes the SST registration process smoother, you still need to prepare some documents beforehand. Get these ready as digital copies (scans or clear photos) to upload:

• SSM Certificate: Your latest company registration documents from Suruhanjaya Syarikat Malaysia (e.g., Form 9/Section 17, Form 13/Section 28, Form D).

• Business Details: Correct BRN, business address, contact numbers, email.

• Director/Owner Info: IC numbers or passport details for the bosses or the person in charge.

• Bank Statement: Just the header showing your business bank account name and number is usually enough.

• Proof of Turnover: Papers that back up your sales figures showing you hit the SST registration threshold (e.g., financial statements, sales reports). Follow the instructions on the MySST application for specifics.

• Business Activity Description: Be ready to clearly explain what your business makes or does.

Having these SST registration documents ready will save you time and hassle during the online SST registration.

What Happens Next? Waiting for Approval & Your SST Number

Once you've submitted your SST registration application, the RMCD will begin reviewing it. You’ll likely receive an instant acknowledgment confirming your submission, but official approval may take a few days as they verify your documents and eligibility.

Be sure to keep an eye on your registered email – that’s where the approval letter will be sent. This letter will include your SST registration number, which is essential for issuing compliant invoices and filing your tax returns through MySST.

What the Approval Letter Tells You

Once you receive your approval letter from RMCD, don't overlook it — it’s a key document confirming your official SST registration. Here’s what to look for:

• Your SST Registration Number – This is your unique identifier for all SST matters. Keep it secure and handy.

• The Effective Date – This is the date you must begin charging and collecting SST on taxable sales.

• Your First Taxable Period – This defines the start of your SST reporting cycle and includes the first SST filing deadline.

From your effective date onward, you're officially part of the SST system. That means you're responsible for charging SST correctly and submitting filings on time.

How to Check SST Registration Status via MySST

Want to check the status of your SST application or confirm whether another business—such as a supplier—is registered? It’s simple. Use the “SST Registration Status” feature on the MySST portal. You can search using:

• Business Registration Number (BRN)

• Company name

• SST Registration Number

This tool is especially helpful for verifying compliance in your supply chain.

With your SST registration complete, you've cleared the first major milestone in your compliance journey—Well done! Next up, let's figure out how to handle the regular SST filing using the SST-02 form.

Section 4: Step-byStep: How to File SST-02 via MySST Portal

Step 1: Visit (https://mysst.customs.gov.my/) to log in MySST Portal. Log in with the User ID and password you got during SST registration.

Step 2: Find the “SST returns” section. It might be under “Return & Payment” or specifically “Sales Tax”/ “Service Tax”

Step 3: Select the two-month period that you want to submit for SST

Step 4: The SST-02 form will appear, and you can start to fill in the form. During you are filling the form, you need to:

• Check the details of the person declaring (name and I/C or Passport number)

• Key in the total value of your taxable sales/ service tax for that period.

• Double check all other fields required for your SST return

Step 5: After confirmation for the details, you can click “save” or “confirm” to save the details

Step 6: How you can submit your SST-02 form

Payment Option

After the SST-02 submission, you are required to make SST payment. We can make the payment with the FPX system. Here is the step:

Step 1: After submitting, click “Pay Now” button and choose FPX payment

Step 2: Select account type. “Corporate Account(B2B)” for Sdn Bhd, LLP or “Individual Account (B2C)” for personal/ sole prop accounts.

Step 3: Pick your bank and enter an email for the receipt, then make payment.

Step 4: Once SST payment is done, you should get confirmation. Please print or save the FPX receipt and the official SST payment receipt from the MySST portal.

Late Penalties Info

As mentioned above, you will get late penalties if you fail to do SST filing or make SST payment on time. For the late SST filing, its fines up to RM50,000, jail up to 3 years, or both.

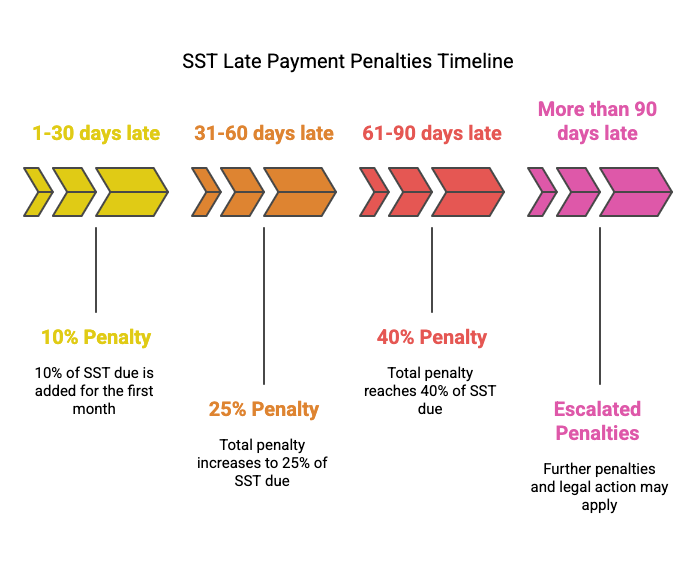

For the late SST payment, its penalties are based on the late period:

1 - 30 days late: 10% of SST due

31 - 60 days late: Another 15% (total 25%)

61 - 90 days late: Another 15% (total 40%)

More than 90 days late: Can go higher plus other action.

How About If you Made a Mistake on the SST-02 form?

If you haven’t pay the SST yet? You still can fix it. You can go back SST return form and reset it.

But if you have already paid? You need to contact RMCD for support.

Section 5: Staying Compliant – Your Malaysian SST Checklist

Now that we've covered SST registration and filing, let’s focus on your ongoing responsibilities: keeping your business fully compliant with SST rules. Staying compliant isn’t just about avoiding penalties—though that’s certainly a good reason—it’s also about building a professional, well-managed business.

Think of it like maintaining a car: regular attention keeps things running smoothly and avoids costly breakdowns.

Here’s a straightforward SST compliance checklist for Malaysian SMEs:

Essential SST Compliance Tasks for Malaysian SMEs (Must-Do!)

Staying compliant with the SST in Malaysia means consistently performing a few key tasks. These aren’t just checkboxes—they're the foundation of proper tax management and business professionalism.

1. Keep Accurate SST Records: Good record keeping is essential. You must maintain detailed, organized records of all

• Sales (taxable and non-taxable)

• Purchases and expenses

• SST collected and paid

These records will support your SST filings, help in case of audits, and ensure transparency in your accounts. Keep everything stored safely for at least seven (7) years, as required by the RMCD.

2. Issue Correct SST-Compliant Invoices: Every invoice you issue must follow SST regulations. That includes:

• Your business name and address

• SST Registration Number

• Invoice date and unique number

• Description of goods/services sold

• The SST amount charged

• Total invoice amount including SST

Incorrect or incomplete invoices could lead to compliance issues, rejected tax credits for your customers, or penalties during audits.

3. File & Pay SST On Time: As mentioned earlier, your SST-02 form must be filed every two months, and payment must be made by the last day of the following month. Missing these deadlines can result in fines or interest charges.

4. Stay Updated on SST Rules: Keep your ears open for any news or changes to SST rules from RMCD via the MySST portal.

Up next, let’s take a closer look at the first two tasks—record keeping and invoicing—as they play a critical role in your day-to-day SST compliance efforts.

SST Record Keeping Is Essential: What You Need to Maintain

Accurate record keeping is one of the most important aspects of staying compliant with SST regulations—and crucial for running your business smoothly. By law, businesses registered under SST are required to maintain proper records of all SST-related transactions and retain them for at least seven (7) years.

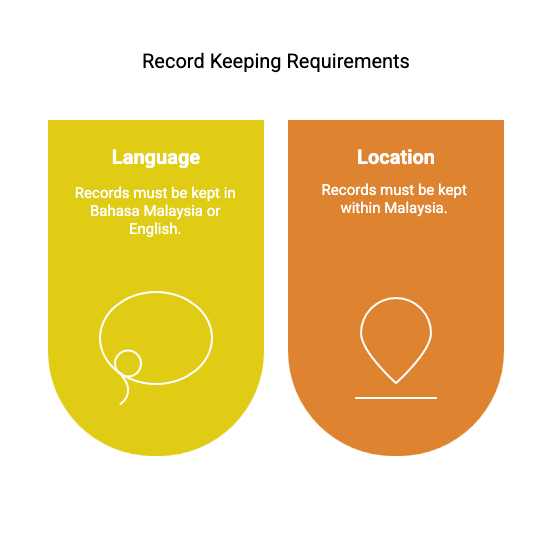

These records must be kept within Malaysia and should be maintained in either Bahasa Malaysia or English. Keeping organized, accessible records not only helps during audits but also supports accurate SST filings and business reporting.

What Kind of SST Records Should You Keep?

To stay compliant with SST regulations in Malaysia, make sure you maintain the following records:

• Sales Invoices (SST-Compliant)

Invoices issued to customers for taxable goods or services. These must clearly show the SST amount charged.

• Credit Notes & Debit Notes

Used to adjust previously issued SST invoices—for example, returns, discounts, or corrections.

• Purchase Invoices

Invoices received from your suppliers. While SST doesn’t allow input tax claims like GST did, these are important for verifying business expenses.

• Import/Export Documentation

Customs forms (e.g., K1, K2), shipping documents, and related paperwork if your business deals with international trade.

• Ledgers & Accounting Records

Includes your sales ledger, purchase ledger, general ledger, and any other financial records that track your SST-related activities.

• SST Account

A dedicated account or section in your bookkeeping that shows SST collected from customers versus SST paid to RMCD.

• Bank Statements

Financial records showing incoming payments from customers and outgoing SST payments to the Royal Malaysian Customs Department.

• Contracts and Agreements

Any business agreements that help explain or support your transactions, pricing, or service terms.

Essentially, you need a clear and complete paper trail to ensure SST compliance—so both the RMCD and your own team can easily verify the numbers submitted in your SST returns.

Trying to manage all these SST records manually, especially when your business starts to grow, can quickly become overwhelming. This is where reliable accounting software becomes a game changer in managing Malaysia’s Sales and Service Tax effectively.

Issuing SST-Compliant Invoices: What Must Be Included

When issuing an invoice for taxable goods or services under Malaysia’s SST system, certain specific details are mandatory to ensure the invoice qualifies as an SST-compliant tax invoice. Missing or incorrect information can create compliance issues for both your business and your customers.

What a Proper SST Invoice Should Include

To comply with Malaysia’s SST regulations, your invoices for taxable goods or services must include the following details:

1. The word “Invoice” – clearly displayed at the top.

2. our business name, address, and SST registration number.

3. A unique invoice number – must follow a consistent and sequential format.

4. Invoice date.

5. Customer's name and address.

6. Description of goods or services provided – must be specific and clear.

7. Quantity or volume of items sold.

8. Total amount payable before SST.

9. SST rate applied – e.g., 5%, 8%, or 10%.

10. Total SST amount charged – displayed separately.

11. Final total amount payable including SST.

12. Price inclusive of SST (if applicable) – you must still show the tax breakdown separately even if SST is included in the price.

Pro Tip: Ensure your invoicing software or template includes all these fields to maintain proper SST compliance and avoid any issues during audits.

Tips for a Smooth SST Audit: Be Prepared, Stay Calm

No one looks forward to an audit—but if RMCD decides to review your records, staying organized and ready can make the entire process much easier. Here are practical tips to help your business prepare for a possible SST audit:

• Keep SST Records Properly Organized: Don’t just throw invoices into a folder or box. Maintain neat, categorized records—either in physical files or as digital copies—for easy reference.

• Reconcile Regularly: Make sure your sales records, SST collected, and bank statements all align. Any discrepancies can raise red flags, so double-check your figures for each SST filing cycle.

• Use Digital Tools: Invest in good accounting software. It helps store, categorize, and access your SST records quickly, making audit preparation much simpler.

• Understand Your SST Declarations: Don’t just file and forget. Make sure you fully understand how the numbers in your SST-02 returns were calculated.

• Respond Promptly and Professionally: If RMCD requests information, reply within the given deadline and keep communication clear and professional. Timely responses show you're compliant and cooperative.

Leveraging Accounting Software (like Niagawan!) for Easier SST Compliance

Let’s face it—handling SST manually can be overwhelming. Managing records, issuing compliant invoices, tracking deadlines, and calculating SST accurately isn’t easy, especially for small business owners juggling multiple roles.

That’s where Malaysian-focused accounting software like Niagawan makes a big difference.

With the right software, you can:

• Auto-generate SST-Compliant Invoices: Templates are already formatted with all the required fields, so you don’t miss anything.

• Keep All Records in One Place: Sales, purchases, SST amounts collected, and even your SST account are tracked and stored neatly in the cloud.

• Simplify SST-02 Filing: The software can summarize SST figures for each taxable period, making return preparation much faster and more accurate.

• Stay On Top of Deadlines: Automated reminders help ensure you never miss an SST filing or payment deadline.

• Easier SST Audits: Digital records are well-organized and easily accessible if RMCD ever comes calling.

Investing in the right tool can save you hours, reduce costly errors, and give you peace of mind knowing your Malaysian SST compliance is under control.

Now, let’s move on to another important area: how SST impacts your pricing strategy. Whether you're charging 5%, 8%, or 10% SST, understanding how it affects your selling price—and your customers' perception—is crucial for staying competitive while remaining compliant.

Section 6: Smart SST Pricing Strategies for Your SME – How to Price Right

Let’s talk money—specifically, how SST fits into your pricing strategy. This part is crucial for staying competitive and compliant under the SST system in Malaysia.

How you apply SST in your prices affects your profit margins, customer perception, and overall business sustainability. The key? Striking a smart balance between legal compliance and practical business sense.

Include or Not? How to Price Your Goods and Services with the Right SST Rate

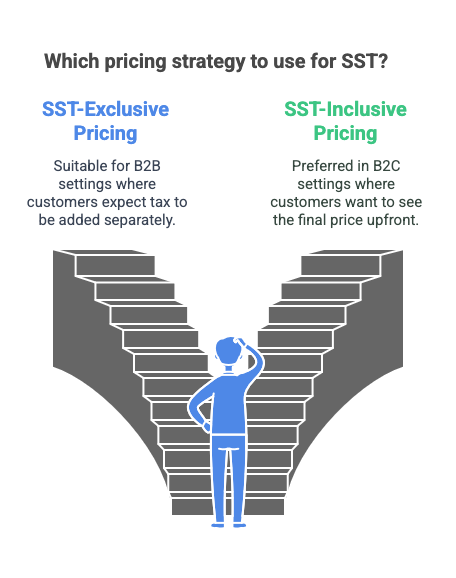

If you're SST-registered in Malaysia, charging the correct SST rate on taxable goods or services is not optional—it's mandatory. The real question is: how should you present this in your pricing? You have two main options:

1. SST-Exclusive Pricing

This means the price you advertise or display does not include SST. The tax is added on top at the point of sale.

Example: RM100 + 6% SST = RM106 total

This approach works well in B2B settings, where customers expect to see tax added separately.

2. SST-Inclusive Pricing

This means the SST is already built into the price you show.

Example: RM106 (includes 6% SST)

This is often preferred in B2C settings where customers prefer to see the final price upfront.

Important:

- You must clearly state whether your price is inclusive or exclusive of SST.

- Even with SST-inclusive pricing, your invoices must break down the taxable amount and show the SST charged separately to stay compliant.

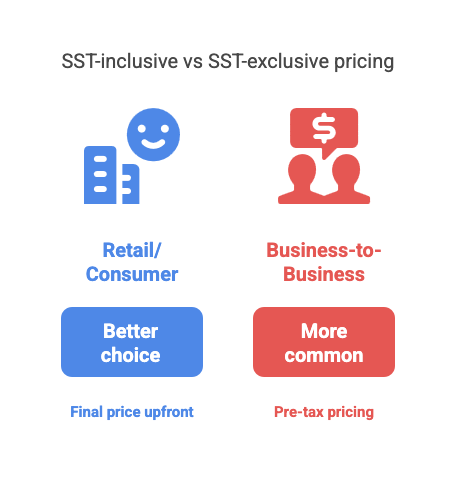

Which SST Pricing Method is Better?

It Depends on Your Industry and Customers

Retail/Consumer (B2C):

SST-inclusive pricing is often the better choice. Customers appreciate seeing the final price upfront with no extra charges at the cashier. It’s transparent and builds trust.

Business-to-Business (B2B):

SST-exclusive pricing is more common in this space. Businesses typically focus on pre-tax pricing for budgeting and accounting purposes.

Regardless of the pricing method, always use the correct SST rate for your goods or services:

Is your product subject to 5%10% Sales Tax?

Is your service charged at the standard 8% Service Tax, or is it under the 6% category (e.g., F&B, telco, logistics)?

Getting the SST rate wrong can lead to serious compliance issues and even penalties. Accuracy matters.

How the Malaysian SST Rate Impacts Your Profit Margins and Costing

Technically, SST isn’t supposed to be a cost to your business—you collect it from your customer and pay it to the government.

But in reality, the SST rate does affect your pricing strategy, cost structure, and perceived value. Here’s how:

• Tighter Margins if You Absorb SST:

If you're in a highly competitive market and decide to include SST in your price without increasing it, your profit margin shrinks.

• Higher Prices if You Pass SST to Customers:

Passing SST directly to customers increases your selling price. This can impact how price-sensitive customers respond, especially in B2C markets.

• Increased Cost of Supplies:

Since SST doesn’t allow input tax credit (unlike GST), the SST you pay on business purchases adds to your cost base, indirectly affecting your bottom line.

• Impact on Discounts and Promotions:

SST must be calculated based on the final selling price after any discounts. This affects your margins during promos and sales events.

Be Clear About SST Charges to Your Customers

Nobody likes hidden charges. So if you're charging SST, make sure your customers understand it. Being clear helps build trust and avoids confusion. Here’s how to do it:

• Show SST on Invoices and Receipts

Always show the SST rate and amount clearly. If the price includes SST, say so. If it doesn’t, show the breakdown.

• Label Prices Properly

If you’re using SST-inclusive prices, let your customers know that the price already includes tax. If not, show the SST as a separate charge.

• Update All Your Price Displays

Whether it’s on your menu, price tags, or website — make sure SST is included or clearly stated.

• Train Your Staff

Your team should know how SST works so they can answer customer questions confidently and correctly.

• Use Simple Words

No need for complicated terms. Just say something like, “This price includes 8% SST” or “SST will be added at checkout.”

Being upfront about SST avoids confusion and potential arguments later. It shows you're professional and follow Malaysian SST rules properly.

Thinking smart about how SST fits into your SST pricing strategy helps you stay compliant, competitive, and profitable. Okay, let's wrap this up in the conclusion!

Section 7: Conclusion – Mastering SST for Your Business in Malaysia

We’ve covered a lot about Sales and Service Tax (SST) in Malaysia. From understanding the difference between Sales Tax and Service Tax, checking if your business needs to register, using the MySST portal, filing SST returns, keeping proper records, to planning your SST pricing strategy – it’s clear that SST is an important part of running a business here.

Recap: Why Understanding SST Matters for Every Malaysian SME Owner

As we've discussed, knowing how SST works in Malaysia isn’t just about avoiding trouble with RMCD. It's about taking control of your business.

In Malaysia’s fast-moving market, especially with SST updates coming in 2025, understanding SST is a smart move. It helps reduce stress about tax matters so you can focus more on growing your business and doing what you love most.

Take Control of Your SST Compliance: Use the Right Tools and Knowledge

SST rules might seem complicated at first, but they’re manageable once you break them down step by step. Remember the key parts of staying compliant: check if your business hits the SST registration threshold, register if required, keep proper SST records, issue SST-compliant invoices, file your SST-02 form and make payments every two months, and stay updated through the MySST portal.

You don’t have to do everything manually or become a tax expert overnight. Use what’s available – like the official MySST guides, and better yet, use modern accounting software such as Niagawan. These tools help automate your calculations, keep your records organised, and make SST filing easier. It saves time, reduces mistakes, and makes handling SST in Malaysia much simpler.

Feeling overwhelmed with SST admin work?

Want to spend less time worrying about SST filing and more time growing your business? Take a look at Niagawan – accounting software designed specifically for Malaysian SMEs. It helps simplify your SST compliance, from generating SST-compliant invoices to preparing for SST-02 filing.

Niagawan is built to be a reliable partner in your SST journey.

Want to see how Niagawan can improve your workflow and give you peace of mind when it comes to SST? Just leave your contact details and our friendly team will be in touch.

Mastering SST is possible. With the right approach and the right tools, you can manage Sales and Service Tax in Malaysia with confidence – and focus on moving your business forward.