Introduction

From GST to SST: A Surprise Call

At Niagawan, we hear all sorts of stories from Malaysian business owners — the good, the bad, and the downright painful. But Mei Lin’s? Let’s just say it had us gripping our seats.

She runs Trendy Threads Boutique in Bukit Bintang — a stylish little shop with loyal customers and racks full of curated outfits. Business was going well. Sales were steady. Mei Lin had even figured out how to handle GST. Sort of.

Then, one afternoon in August 2018, her accountant, Mr. Tan, called her out of the blue.

“Mei Lin, have you heard of it? GST is gone. SST coming back next month.”

She stared at her phone. What?

"I almost spilled my milk tea,” she later told us. “I just got used to the GST. Now they want me to learn something new?”

At first, she shrugged it off. How different could it be?

Spoiler: Very different.

She did what most business owners do — Googled a bit, asked around, copied what others were doing, and hoped for the best. SST-02? Submit online. Done.

But then came January.

A regular Tuesday. Mei Lin was arranging the new arrivals when two Kastam officers walked into her boutique. She thought maybe they were there for an inspection. Or maybe just lost?

The RM3,000 Wake-Up Call

Nope.

They were there to inform her she’d been submitting her SST-02 forms wrongly — for months.

The fine? RM3,000.

“I just stood there. My mind went blank. I didn’t even know what mistake I made. I wanted to argue — but I had no clue what to say.”

It was the kind of moment that makes you stop everything.

Because that was the day Mei Lin realised: guessing your way through taxes isn't “being resourceful.” It’s risky. And expensive.

After that RM3,000 wake-up call, Mei Lin knew she couldn’t afford to “wing it” anymore. So she rolled up her sleeves, opened her laptop, and started digging into the nitty-gritty of SST — starting with the biggest question on her mind:

“Who actually needs to register?”

Which Businesses Need to Register for SST in Malaysia?

After receiving a RM3,000 penalty from customs, Mei Lin knew it was time to get serious. No more guesswork—she needed to understand SST clearly.

Her first big question was: “Does my business actually need to register for SST?”

She was confused. Her boutique sells imported fashion from Bangkok and Korea, and also offers clothing alteration services. Did this combination make her eligible for SST registration?

She reached out to her friend Sarah, who owns a café in the city.

“Did you register for SST?” Mei Lin asked.

Sarah replied that her café hadn’t registered because it hadn’t reached the required sales threshold.

Mei Lin paused. “What threshold?”

Sales Tax vs. Service Tax: What Applies to Your Business?

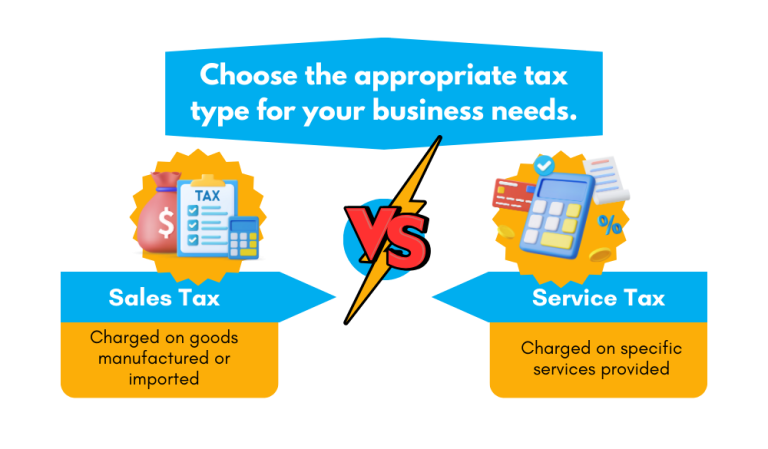

This was Mei Lin’s first important discovery: SST is not just one tax, but two.

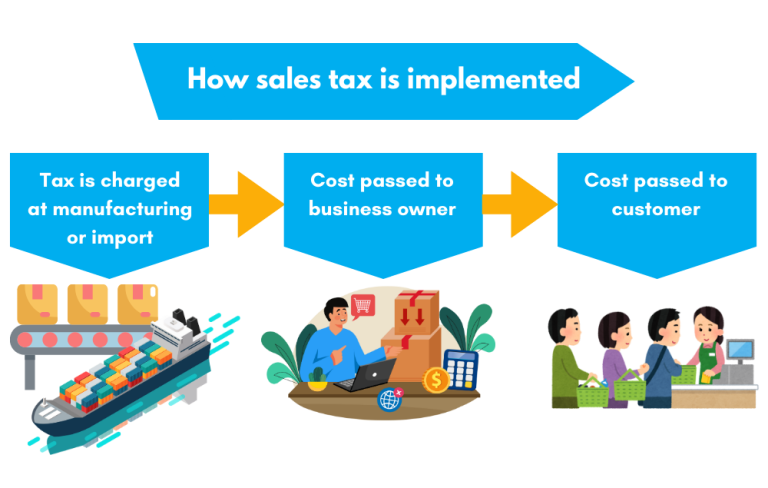

Sales Tax — applies to taxable goods manufactured locally or imported into Malaysia. It is collected by manufacturers and importers.

Service Tax — applies to specific services provided within Malaysia.

As a retailer who simply imports and sells clothing, Mei Lin felt relieved—she did not need to register for Sales Tax. That responsibility had already been handled by her suppliers or importers.

But there was still a concern. Her boutique also provided alteration services. Would this count as a taxable service under Service Tax?

SST Thresholds: Do You Qualify?

After consulting a tax expert, Mei Lin learned about the SST registration thresholds:

For most service-based businesses (like tailoring), you are required to register for SST if your annual turnover exceeds RM500,000.

For food and beverage businesses, the threshold is higher—RM1.5 million annually.

During lunch one day, Mei Lin shared this information with Sarah.

“You still have some time before you need to register,” she said.

Sarah nodded. “Yes, but my café has already reached RM1.2 million this year. I might need to register next year.”

As for Mei Lin, her boutique was generating RM600,000 per year in total revenue, but only RM120,000 came from alterations.

Since her service income was below the RM500,000 threshold, she didn’t need to register for Service Tax either. That was a big relief.

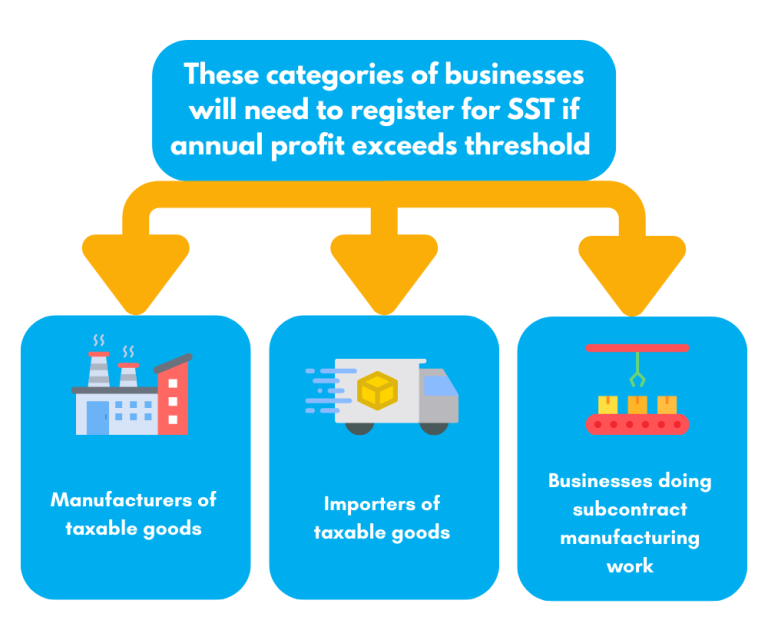

Who Must Register for Sales Tax?

While retailers like Mei Lin may not be directly affected by Sales Tax, others in the supply chain are.

If your business fits into any of the following categories and exceeds RM500,000 in taxable turnover, SST registration is required:

1. Manufacturers of taxable goods in Malaysia

2. Importers of taxable goods into Malaysia

3. Subcontract manufacturers

For example, Mei Lin’s acquaintance, Mr. Wong, owns a t-shirt manufacturing business in Penang. When his annual revenue exceeded RM500,000, he had to register for Sales Tax.

“It’s a lot of extra work,” he shared during a trade show. “Now I have to charge 10% Sales Tax on every shirt and submit tax forms every two months.”

Mei Lin asked, “Do you include the tax in the selling price?”

“Yes, but I still need to report everything to the customs office regularly. It’s a lot to keep track of.”

For example, Mei Lin’s acquaintance, Mr. Wong, owns a t-shirt manufacturing business in Penang. When his annual revenue exceeded RM500,000, he had to register for Sales Tax.

“It’s a lot of extra work,” he shared during a trade show. “Now I have to charge 10% Sales Tax on every shirt and submit tax forms every two months.”

Mei Lin asked, “Do you include the tax in the selling price?”

“Yes, but I still need to report everything to the customs office regularly. It’s a lot to keep track of.”

Service Tax Isn’t Just for Big Corporations

As Mei Lin dug deeper into SST, she realized it wasn't just about selling goods—services mattered too.

Service Tax applies to specific taxable services. If your business provides any of the following and exceeds the registration threshold, you must register:

• Hotels and accommodations

• Restaurants and cafes (threshold: RM1.5 million)

• Nightclubs and karaoke centers

• Professional services (lawyers, accountants, consultants)

• Insurance and takaful providers

• Telecommunications companies

• Parking operators

• Many more listed by the Royal Malaysian Customs Department

Take Mei Lin’s cousin, Amir, for example. He runs a small accounting firm in Subang Jaya. When his firm’s annual revenue reached RM550,000, he was legally required to register for Service Tax.

"Now I have to charge clients an extra 8% Service Tax," he mentioned during their Hari Raya family gathering. "Some clients weren’t happy, but this isn’t optional—it’s required by law."

This was an eye-opener for Mei Lin. Even small service-based businesses aren't exempt once they cross the threshold.

Exemptions: Who Doesn’t Need to Register?

Fortunately, not all businesses are required to register for SST. There are exemptions that can ease the compliance burden.

You’re exempt from registering if:

• You manufacture non-taxable goods

• Your annual revenue is below the SST threshold

• You fall under a list of specific exempted activities provided by customs

One of our Niagawan users in Terengganu runs a small home-based batik manufacturing business. Since traditional batik is categorized as non-taxable, she doesn’t have to charge Sales Tax.

Mei Lin came across her story while browsing our user case studies. “So she doesn’t need to worry about Sales Tax at all?” she thought. “That’s a huge relief compared to my situation where Sales Tax is already built into the clothes I import!”

This distinction matters. Understanding whether your goods or services fall under taxable categories can save you from unnecessary penalties—or missed compliance.

How to Check if Your Business Needs to Register for SST

When Mei Lin first tried to figure out if she needed to register for SST, she admitted it felt overwhelming. The rules weren’t exactly written in plain English, and there was a lot of conflicting information online.

Here’s the step-by-step approach we recommend (and the same one Mei Lin followed with help from our Niagawan guide):

1. Calculate your annual turnover for each business activity—especially those that might be taxable.

2. Check the official list of taxable goods and services to see if your business falls under Sales Tax or Service Tax.

3. Review the exemptions provided by the Royal Malaysian Customs Department to see if any apply to your situation.

4. If you're still uncertain, contact Kastam’s helpline (be prepared for long wait times!)

Some of our Niagawan users also find value in joining business owner groups or forums where they exchange SST tips and experiences. Sharing real-life stories can make tax compliance a little less intimidating.

How to Charge Customers for SST and Submit the SST-02 Form to Kastam

Once Mei Lin discovered she had to register for Service Tax, her next big question was: “Now what?”

At Niagawan, we often hear the same concerns from users like her:

How do I start charging customers for SST?

What should go on the invoice?

And what exactly is this SST-02 form?

Let’s walk through the journey, just like how we guided Mei Lin.

How Sales Tax Works in Real Life

Sales Tax is usually handled at the manufacturing or import stage, so most retailers like Mei Lin don’t charge it directly. It’s already included in the cost of goods they purchase.

For example, Mei Lin sources her boutique clothing from a supplier in Bangkok. While the supplier doesn’t bill her for Sales Tax, the Malaysian importer pays the tax when the goods arrive — and this cost gets passed on to Mei Lin in the wholesale price.

She used to be confused and kept asking, “Where’s the Sales Tax on my invoice?” We reassured her that she wasn’t missing anything — it’s already factored into her cost price. In retail, the tax is hidden, but it’s definitely there.

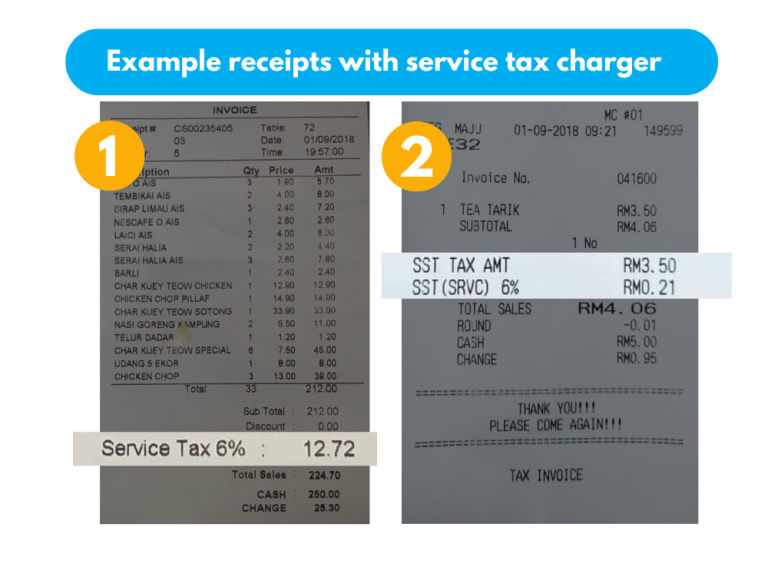

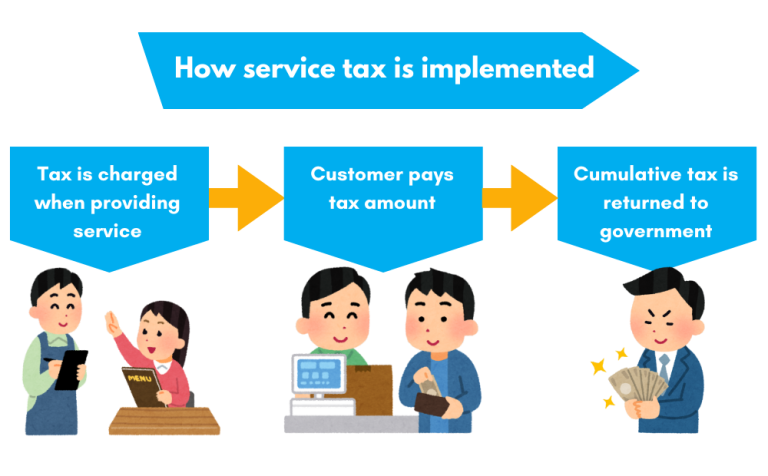

How Service Tax Works in Real Life

Service Tax, on the other hand, is much more visible.

Once a business is registered, it must charge customers the Service Tax directly — currently 8% for most services (effective March 2024), though F&B services remain at 6%.

One of Mei Lin’s friends, Lisa, runs a beauty salon in Damansara.

When her business crossed the threshold last year, she had to start charging Service Tax on treatments and packages.

“Some customers weren’t happy,” Lisa told Mei Lin. “A few even asked for discounts to cover the tax.”

Lisa explained that she calmly educated them — it’s a legal requirement, not a business decision.

Most eventually understood. And with Niagawan, she was able to display the tax clearly on every receipt, which helped avoid confusion and built trust.

The Dreaded SST-02 Form

This was the part that worried Mei Lin the most — tax submission.

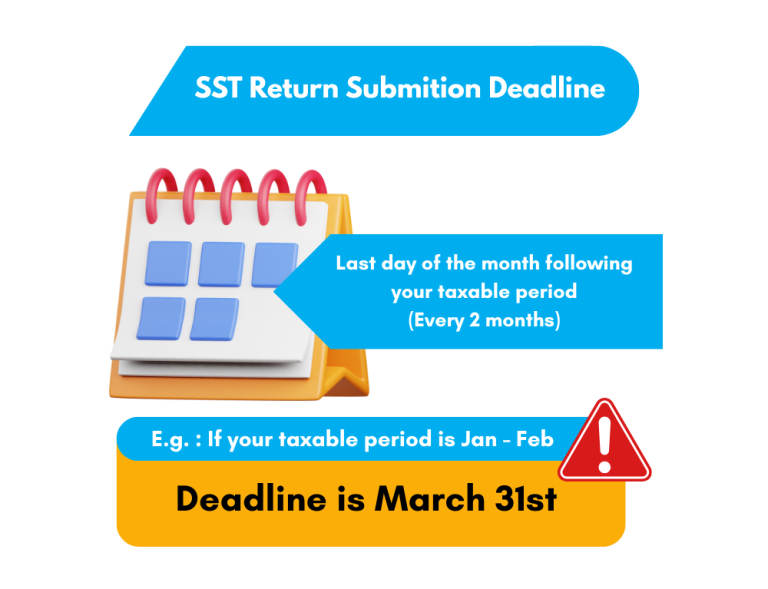

The SST-02 form is the return that businesses must submit every two months, even if no tax is due for that period.

It’s used to declare total taxable sales and the Service Tax collected.

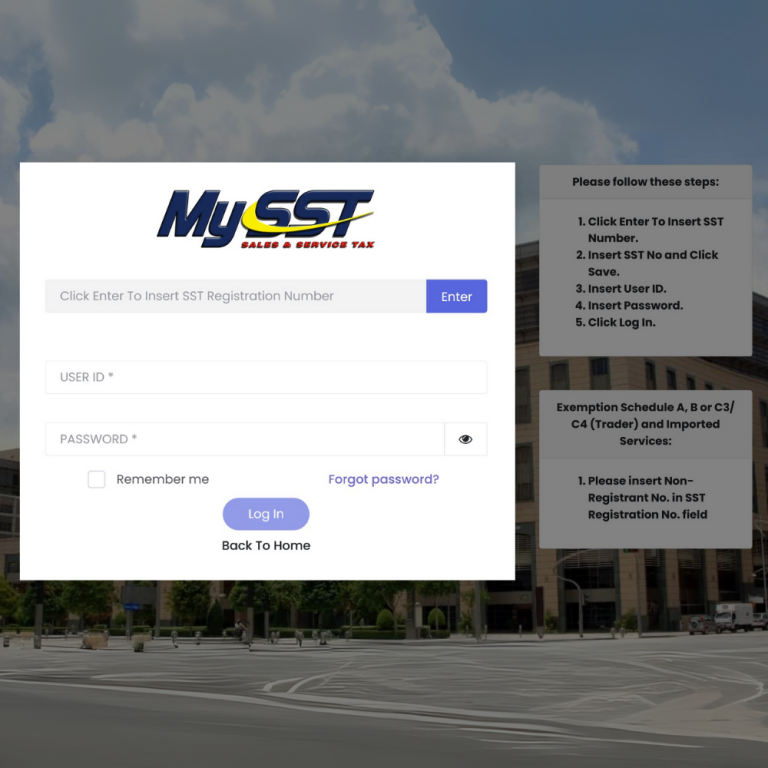

Mei Lin visited her accountant friend Amir for help. He opened up his laptop and showed her how to log into the MySST portal.

“See? It’s not as complicated as it looks,” he said, guiding her through the process. “But you do need to be careful with deadlines. Missing them can result in fines.”

She learned that the deadline is the last day of the month following each taxable period.

So for January–February, the form must be submitted by March 31st.

Amir also showed her the two submission options — manual entry via the portal or using software to generate reports.

Two Ways to Submit the SST-02 Form

After showing Mei Lin how to log in to the MySST portal, Amir walked her through the two available submission methods.

Option 1: Online Submission

Log in to the MySST portal

Go to the SST-02 submission section

Fill in the required details

Submit the form electronically

Save the acknowledgment receipt for your records

“Most of my clients prefer the online method,” Amir told her. “It’s faster, more secure, and you don’t have to wait in line at the post office.”

Option 2: Manual Submission

Download the SST-02 form from the MySST portal

Complete it in BLOCK LETTERS

Mail it to the Customs Processing Centre

“But to be honest,” Amir said with a grin, “not many people have time to print forms and post them anymore. Online submission is the practical choice.”

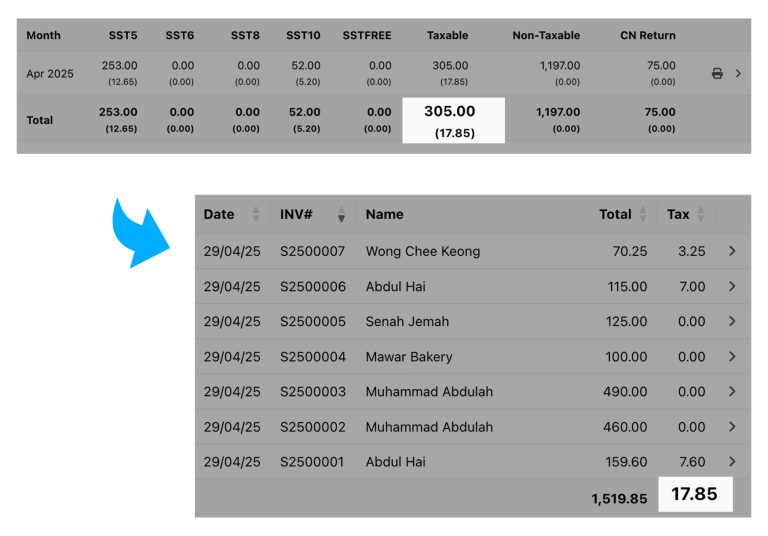

Mei Lin nodded, feeling relieved. With Niagawan’s SST report feature, she already had all the figures she needed — she just had to transfer the numbers into the portal.

How to Make SST Payments

Once you’ve completed the SST-02 form and calculated how much tax is due, the next step is payment — and it must be made by the same deadline as your submission.

You can choose from:

• Electronic banking via FPX

• Cheque or bank draft (for manual submissions)

“Just avoid post-dated cheques at all costs,” Amir advised. “Customs won’t accept them, and late payments will incur penalties.”

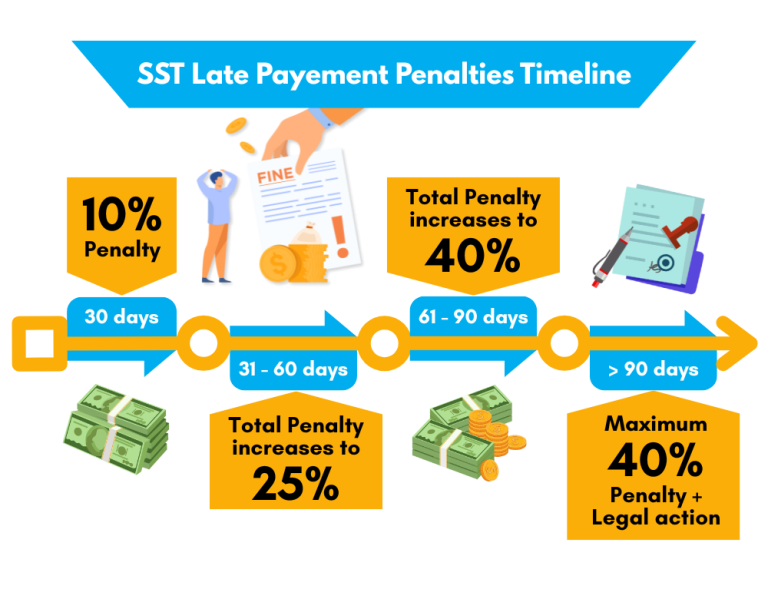

Penalties That Could Hurt Your Business

Late SST submissions are taken seriously by the Royal Malaysian Customs Department, and the penalties can be costly.

One Niagawan user shared their experience after missing a deadline:

• Within the first 30 days late: 10% penalty

• 31–60 days late: Additional 15% (total 25%)

• 61–90 days late: Additional 15% (total 40%)

• Beyond 90 days: Maximum 40% plus potential legal action

“That’s why I always make sure to submit my SST-02 form at least one week before the deadline ,” the user said. “It’s just not worth the financial and legal risk.”

With Niagawan, users can generate their SST reports accurately and on time, reducing the risk of errors and missed deadlines — and ultimately avoiding costly penalties.

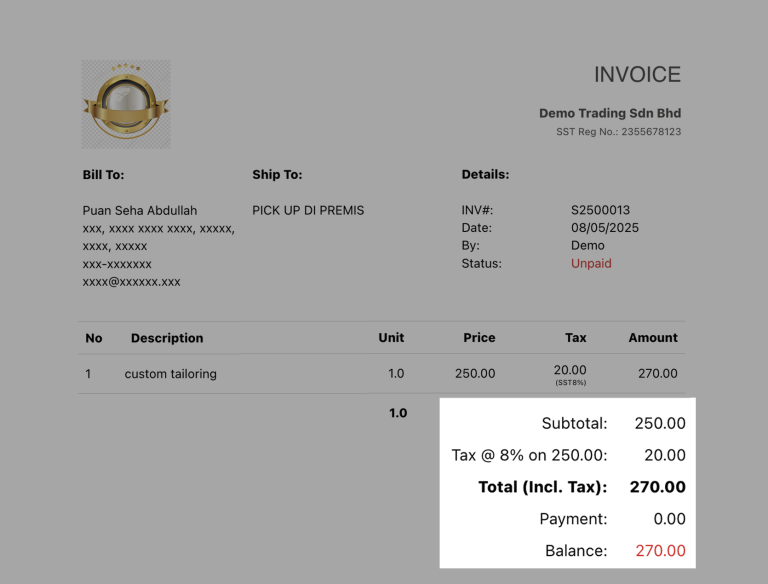

A Success Story from a Niagawan User: Jasmine’s Boutique

One of our long-time users, Jasmine, who is also a friend of Mei Lin, runs a successful boutique in Pavilion KL.

Unlike Mei Lin, Jasmine offers custom tailoring services — a taxable service that exceeded the threshold, so she was required to register for Service Tax.

When Mei Lin visited her boutique recently, she asked Jasmine how she manages the SST process.

“Honestly, once you have the right system in place, it becomes routine,” Jasmine explained as they chatted over tea in her office. “I use Niagawan to handle all the Service Tax tracking.”

She opened her laptop and showed Mei Lin a sample receipt from her system:

Custom Tailoring: RM250

Service Tax (8%): RM20

Total: RM270

“Everything is automatically calculated and documented,” she said. “Then every two months, I download the SST report from Niagawan and pass it to my accountant for submission.”

When asked if she had any advice for other business owners, Jasmine shared:

“Always set reminders before the deadlines, keep all your records updated, and don’t hesitate to check directly with Kastam if you’re unsure. It’s better to ask than to guess and risk a penalty.”

Thanks to Niagawan, Jasmine is able to run her boutique efficiently while staying compliant — no stress, no surprises.

Tips From Someone Who's Been There

After going through the SST registration process and learning from other Niagawan users like Jasmine and Amir, Mei Lin had some practical advice to share with fellow business owners:

1. Keep detailed records of all taxable and non-taxable transactions

2. Set calendar reminders ahead of SST-02 submission deadlines

3. Use a system like Niagawan to auto-calculate, track, and export SST reports

4. Join business communities to exchange real experiences and SST tips

5. When in doubt, reach out to a certified accountant or call Kastam directly

“I used to feel overwhelmed about SST,” Mei Lin admitted. “But once I started using Niagawan and built a routine, it became much more manageable. Now everything is tracked in one place, and I can submit my SST-02 confidently.”

Conclusion: Mei Lin’s Journey with SST — From Confused to Confident

What started as a panic-filled visit from Kastam officers became a turning point for Mei Lin. Today, with the help of Niagawan, she feels much more in control of her SST obligations — and she hopes her story can help other business owners too.

Let’s recap her key takeaways:

• SST consists of two components: Sales Tax and Service Tax

• Businesses must register once annual taxable turnover exceeds RM500,000 (or RM1,500,000 for F&B)

• As a boutique retailer, Mei Lin doesn’t need to register for Sales Tax — it’s already included in her inventory cost

Her alteration services stay below the threshold, so no Service Tax registration is required either

• For those who do register, the SST-02 form must be submitted every two months

• Online submission through the MySST portal is faster and more efficient than manual methods

• Late submissions can lead to serious penalties — it’s crucial to meet the deadlines

By using Niagawan, Mei Lin no longer worries about missing a step. From tracking taxable sales to generating SST reports, everything she needs is just a few clicks away.

Her advice to other entrepreneurs?

“Take the time to understand your obligations. Use tools like Niagawan to simplify compliance. And never ignore that knock on the door — it could save you from costly penalties later!”