This article will guide you through various methods of recording sales, whether manually or using digital systems, specifically designed to assist SMEs in Malaysia. We’ll show how accurate sales records can enhance operational efficiency and empower your financial management.

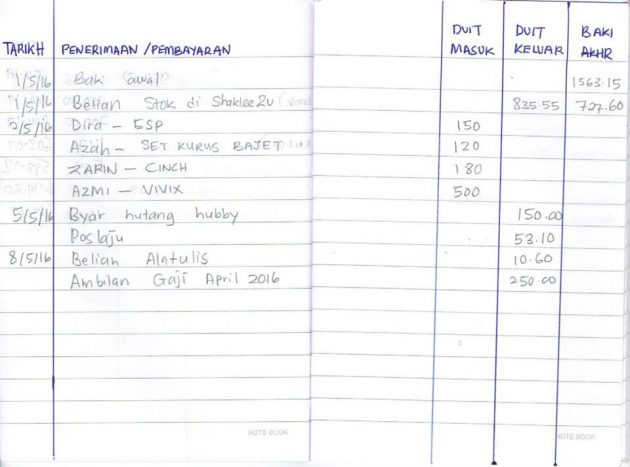

Sales records are the foundation of successful business management. Traditionally, many SME owners have recorded their sales manually using notebooks or spreadsheets like Excel.

Using a notebook to log sales may seem simple and affordable, but it comes with numerous risks. Human errors like miscalculations, missing information, or unclear entries are common problems. Additionally, this process is time-consuming, especially when sales volume increases.

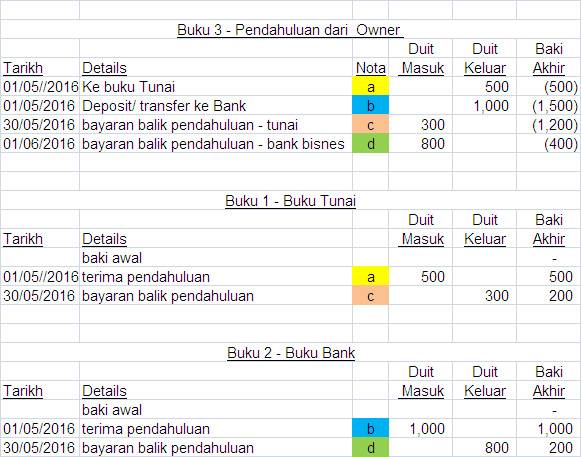

Excel is a step ahead of notebooks as it allows for automated calculations and maintains more organized records. However, the major drawback of using Excel is that it still requires manual input and doesn’t provide comprehensive financial reports automatically. It also requires some skills, and if you're not proficient, it can be quite complicated.

The primary advantage of manual methods is the low cost and full control over data. However, the downsides include issues with accuracy, the time it takes, and the inability to store long-term records efficiently. In the modern business world, these traditional methods are no longer sufficient, especially as a business grows.

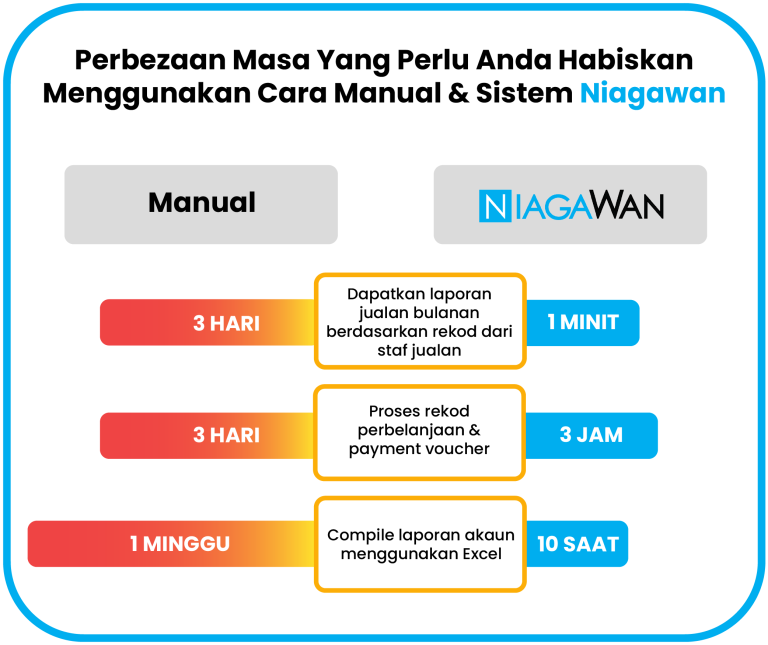

As technology becomes more prevalent, SMEs in Malaysia need to switch to digital methods for recording sales. Systems like NiagaPlus and NiagaPos simplify this process by offering various features that make it easier for small businesses.

POS systems are a popular digital tool among retail businesses. They allow sales records to be automated and synced with inventory. With a POS system, every transaction is logged in real time, and sales reports are easily accessible. While the initial cost might be higher, the long-term benefits like daily performance monitoring and stock management are well worth it.

Niagawan have a mobile POS system that SME business owner no need to invest in expensive machine and tablets. With NiagaPos, all you need are these 3 simple steps:

1. Download App

2. Connect to a Bluetooth Printer

3. Print Receipts

[Get more information about NiagaPos]

system like NiagaPlus offers a convenient solution for recording sales from anywhere. With cloud-based software, you can access sales data anytime from any device. It also allows you to share financial information with your accountant or business partners without the need for physical documents.

NiagaPlus, the premium product from Niagawan, offers the advantage of sales record automation that can be customized to your business needs. With this automation, financial reports like profit and loss statements and bank reconciliations can be generated automatically, saving time and reducing the risk of errors.

[Get more information about NiagaPlus]

Choosing the right sales record system can be a daunting task, especially with the many options available in the market.

A good sales record system should provide easy access to financial reports, inventory tracking, and customer management. Additionally, it should have features like automated invoicing and real-time transaction records, as offered by Niagawan.

Before choosing a system, it's important to consider the cost compared to your business needs. Systems like Niagawan offer various pricing plans that can be tailored to suit businesses of different sizes. Additionally, ease of use is an important factor; a system that is too complicated can slow down daily operations.

Accurate sales records bring a variety of benefits to businesses, particularly in decision-making and financial management.

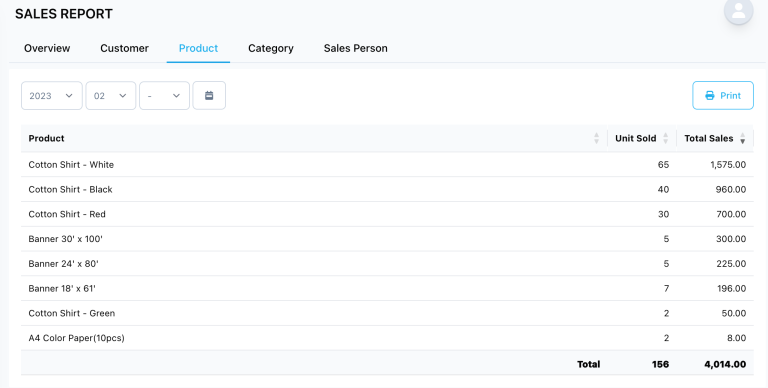

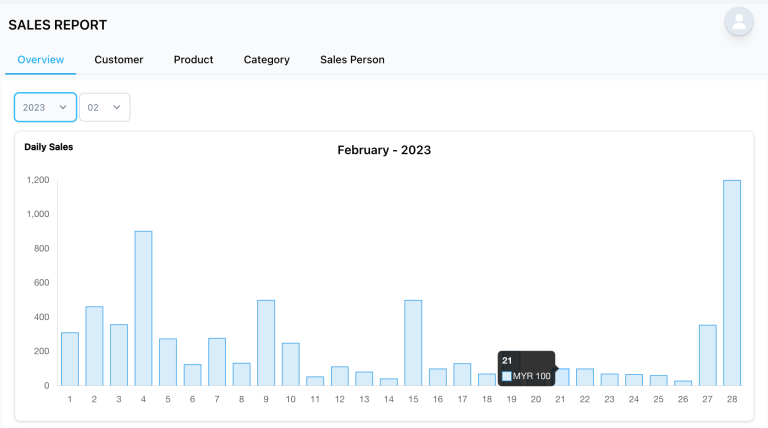

With accurate sales records, you can clearly see your business trends. You can identify the best-selling products or services and make smarter decisions in your sales and marketing strategies. Systems like NiagaPlus provide in-depth analytical reports to help you plan for your business's future.

Good sales records allow you to monitor your cash flow and business profits. With automated financial reports, Niagawan helps business owners easily track their financial performance. This is important to ensure your business remains financially stable.

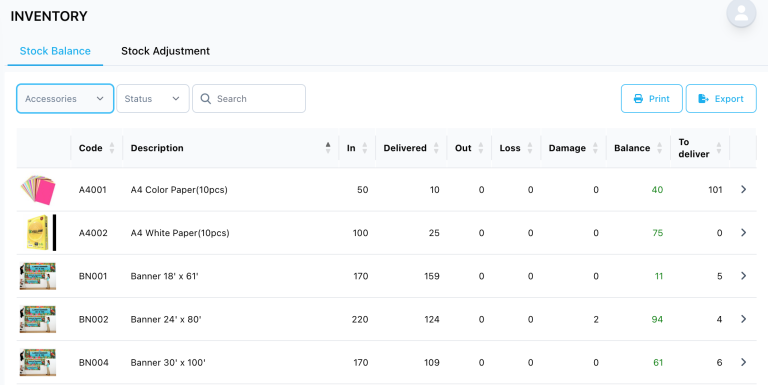

Another major benefit of accurate sales records is better inventory management. With digital systems, you can view real-time inventory and avoid over-purchasing. This helps reduce waste and ensures stock is always sufficient for business needs.

Niagawan is a Cloud-based Accounting System designed specifically for SMEs in Malaysia, offering various tools to simplify the sales recording process.

Niagawan is designed to be user-friendly, even for those less tech-savvy. With its simple interface and streamlined processes, business owners can record sales, generate invoices, and monitor their finances without hassle. The system can also be integrated with other platforms to facilitate business operations.

With NiagaPlus, business owners gain access to detailed financial reports, including financial statements, bank reconciliations, and sales analysis. Automation features reduce the workload, allowing you to focus on other aspects of your business.

Recording sales is one of the most important aspects of business management, especially for SMEs in Malaysia. Whether you use manual methods or switch to digital systems, it’s essential to ensure that your sales records are well-organized. Systems like Niagawan and NiagaPlus offer comprehensive solutions, making this process easier with automation, detailed financial reports, and efficient inventory management features. With accurate sales records, you can not only manage your business better but also make smarter decisions for long-term growth.