As an SME boss, running an SME can feel like you’re always playing catch-up, especially when it comes to managing finances. So, it’s essential to have a clear understanding of your business's financial health.

Many business owners get caught up in daily operations and often overlook the importance of financial statements—key documents that can help you understand your company’s performance and plan for growth. These statements are not just for accountants; they’re for you, the business owner, to make informed decisions that will guide your enterprise toward long-term success.

In this blog post, we’ll break down the core components of financial statements, explain how they can help your business thrive, and provide actionable tips on how to use them effectively. Whether you’re new to managing finances or simply looking to brush up on your knowledge, this guide is designed to simplify the process.

A financial statement is a formal record of your business's financial activities. It provides a clear snapshot of where your company stands financially at any given moment.

This data is crucial for internal management and external stakeholders, such as investors, banks, and tax authorities. Essentially, financial statements allow you to keep track of your company’s assets, liabilities, income, and cash flow, making it easier to make well-informed business decisions.

There are three main types of financial statements that every SME boss should be familiar with: the balance sheet, income statement, and cash flow statement.

Each of these plays a distinct role in helping you understand different aspects of your business’s financial health. In the sections below, we will break down each of these statements to make them easier to understand and use in your daily operations.

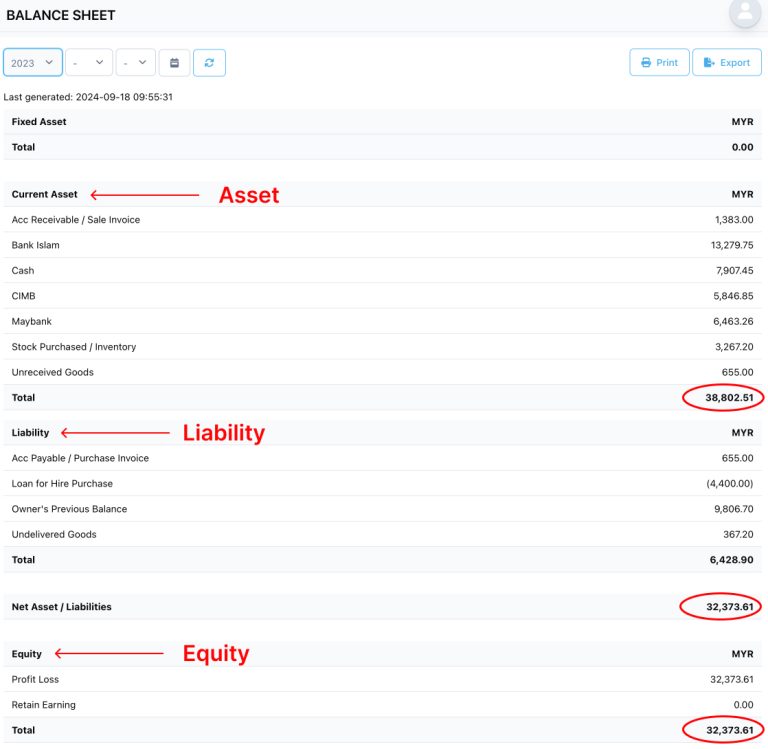

The balance sheet is a snapshot of your business’s financial position at a specific point in time. It outlines three key elements: assets, liabilities, and equity.

Assets: These are the resources your company owns, such as cash, inventory, equipment, and receivables (money owed by customers).

Liabilities: This refers to what your company owes, such as loans, accounts payable (money owed to suppliers), and other financial obligations.

Equity:Equity represents the ownership of the business. It’s what’s left when you subtract your liabilities from your assets. In essence, it’s the company’s net worth.

The balance sheet follows the formula:

Assets = Liabilities + Equity

This equation must always be in balance, hence the name "balance sheet." Understanding this document helps you know what your business owns, what it owes, and what’s left over after paying off your debts.

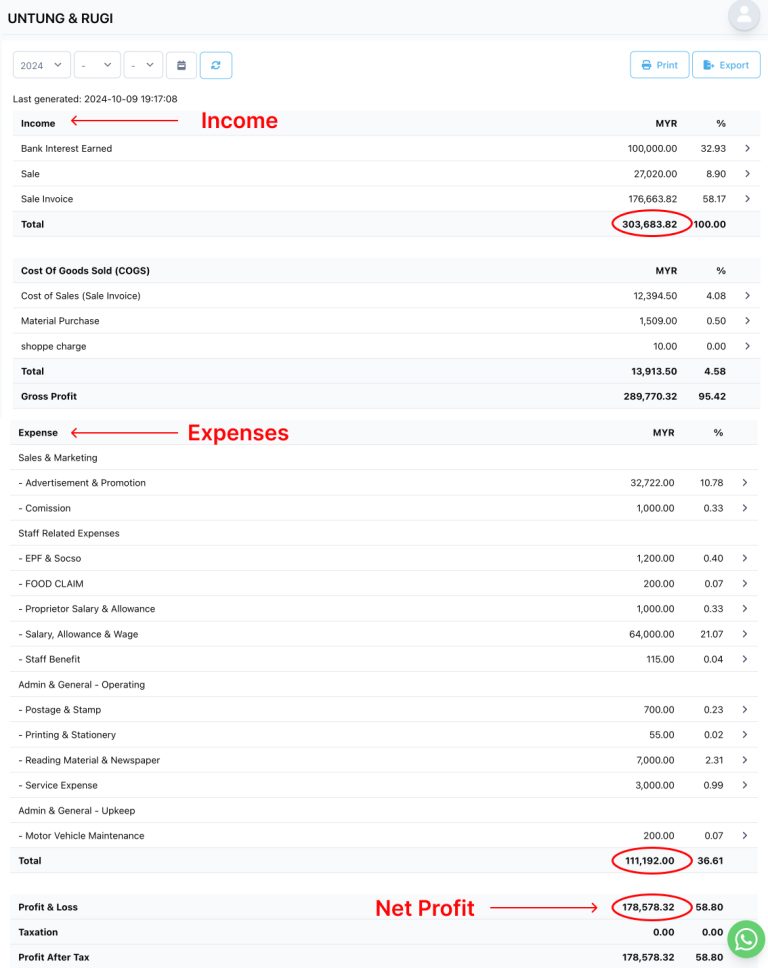

The income statement, also known as the profit and loss (P&L) statement, details your company’s revenues, costs, and expenses during a specific period, usually a month, quarter, or year. This statement shows whether your business is profitable or not.

Revenue: The total amount of money your company earns from sales.

Expenses: Costs incurred in running the business, such as rent, utilities, salaries, and cost of goods sold (COGS).

Net Income:This is your bottom line—the profit or loss remaining after all expenses are deducted from revenue.

An income statement helps you see where your money is coming from and where it’s going. If you’re losing money, the income statement helps identify areas where you can cut costs or increase revenue.

To understand more regarding profit and loss statement, read this article>> What Is a Profit and Loss Statement? A Comprehensive Guide for Beginners

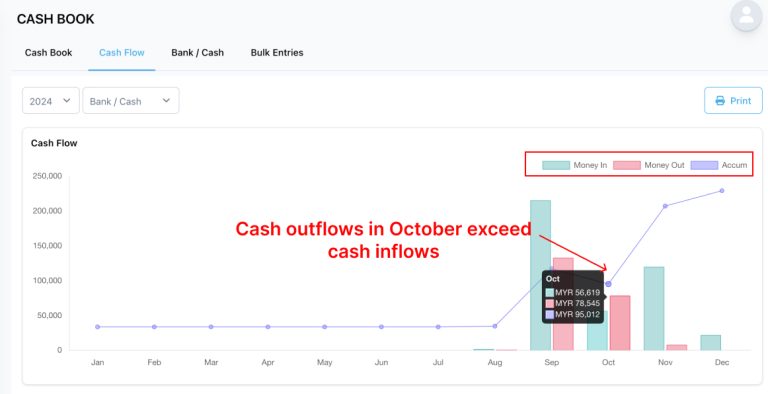

The cash flow statement is one of the most important financial statements, especially for SMEs. It tracks the flow of cash in and out of your business. While the income statement shows profitability, the cash flow statement gives you insight into your liquidity—how much cash you have on hand to cover expenses.

Cash flow is divided into three main activities:

Operating Activities: This shows the cash generated from your core business operations, such as sales of goods and services.

Investing Activities: This includes cash flow from buying or selling assets like equipment or property.

Financing Activities:This refers to cash flow related to borrowing or repaying loans, issuing shares, or paying dividends.

Aktiviti Pembiayaan: Ini merujuk kepada aliran tunai yang berkaitan dengan peminjaman atau pembayaran balik pinjaman pengeluaran saham, atau pembayaran dividen.

Having a positive cash flow is critical for SMEs, as it means you have enough cash to cover daily operations and future investments.

Financial statements provide valuable insights into your business’s financial health, but you need to know how to interpret them correctly to make informed decisions.

Here are some key financial metrics and ratios that can help you analyze your financial statements effectively:

4.1 Profitability Ratios: These measure how efficiently your business is generating profit. Key ratios include gross profit margin and net profit margin.

4.2 Liquidity Ratios:These ratios, such as the current ratio and quick ratio, assess your company‘s ability to pay off short-term obligations with available assets.

4.3 Solvency Ratios: these measure your company’s ability to meet long-term obligations, with ratios like the debt-to-equity ratio giving insight into how your business is financed.

For example, if your liquidity ratios show that you have less than 1.0, it indicates that you might struggle to meet short-term liabilities, signaling a need to improve cash flow or reduce liabilities.

Many SME bosses, especially those new to managing finances, tend to make common mistakes when dealing with financial statements. Here are a few you should avoid:

5.1 Focusing Only on Profits: Many business owners fixate on the income statement and overlook cash flow. A business can be profitable on paper but still fail due to poor cash flow management.

5.2 Not Reviewing Financial Statements regularly: Waiting until the end of the financial year to review your financials can lead to missed opportunities or costly mistakes. You should review these documents monthly or quarterly.

5.3 Misinterpreting Financial Data: Not understanding the difference between profitability and cash flow can lead to bad financial decisions, like taking on more debt when your cash flow can’t support it.

With NiagaPlus, financial statements are updated in real-time, giving you access to accurate data whenever you need it. This helps you avoid costly mistakes by keeping you informed of your business’s financial health on an ongoing basis.

One of the most significant benefits of regularly reviewing your financial statements is that it enables you to spot trends and identify growth opportunities.

Whether you’re looking to expand your operations, invest in new equipment, or hire more staff, understanding your financial health is crucial.

Here’s how regularly reviewing your financial statements can help:

6.1 Cash Flow Management: Monitoring your cash flow statement helps you ensure you have enough cash to cover expenses and invest in growth opportunities.

6.2 Planning for the Future:Financial statements provide a roadmap for future planning. By forecasting income and expenses, you can set realistic growth targets and allocate resources efficiently.

6.3 Improved Decision-Making: Having accurate and up-to-date financial information allows you to make smarter decisions about your business, such as when to invest, when to save, and when to cut back.

To help every SME bosses to understand their business’s financial health clearly, We provide a cloud-based accounting system with automation and user-friendliness.

Our system allows users to quickly access the financial reports that are generated automatically. The financial statement is updated in real-time, giving you access to accurate data whenever you need it. Hence, user can focus on their business development and decision-making.

Understanding and regularly reviewing your financial statements is key to running a successful SME. The balance sheet, income statement, and cash flow statement clearly show your business’s financial health, allowing you to make smarter, data-driven decisions.

By learning how to interpret these statements and avoiding common mistakes, you can drive growth and ensure the long-term success of your company.