Tax penalties can be a significant burden for small and medium enterprises (SMEs) in Malaysia. Missed deadlines, inaccurate records, and human errors can lead to costly fines and legal repercussions.

Fortunately, there is a solution: e-Invoicing.

With e-invoicing, businesses can streamline their accounting processes, enhance accuracy, and reduce the risk of tax non-compliance. In this post, we will explore the benefits of e-invoicing and provide practical tips for its implementation in Malaysia.

E-invoicing refers to the process of creating, sending, and receiving invoices electronically. In Malaysia, e-invoicing is increasingly becoming mandatory for businesses, especially as the government drives digitalization initiatives.

The Inland Revenue Board of Malaysia (LHDN) has launched various initiatives to encourage the adoption of e-invoicing among SMEs. These initiatives include providing guidelines, training programs, and support services to help businesses transition from traditional paper-based invoicing to electronic invoicing.

E-invoicing offers a range of benefits that not only assist with tax compliance but also improve overall business operations. Here are some key advantages:

Improved Accuracy:

E-invoicing eliminates the risk of human errors that often occur during manual data entry. With automated systems, invoices are generated more accurately, reducing the chances of mistakes that could result in tax penalties.

Enhanced Efficiency:

The invoicing process becomes faster and smoother with e-invoicing, saving time and resources. Businesses can create, send, and receive invoices electronically, minimizing paperwork and speeding up workflow.

Better Cash Flow Management:

E-invoicing enables businesses to monitor unpaid invoices in real-time. This allows them to take immediate action on outstanding payments, ultimately helping to improve cash flow.

Increased Tax Compliance:

E-invoicing helps businesses adhere to tax regulations by providing organized and accurate electronic records. These records can be easily submitted to the LHDN during audits, minimizing the risk of penalties.

E-invoicing plays a crucial role in helping businesses avoid tax penalties in several ways:

1. Accurate Record Keeping:

E-invoicing ensures that all invoices are created, stored, and tracked electronically, providing reliable and precise records of all business transactions. This simplifies compliance with tax regulations.

2. Timely Submission: With up-to-date electronic records, businesses can easily gather information for tax returns and submit them on time, avoiding late submission penalties.

3. Reduced Errors:

E-invoicing eliminates the risks associated with manual data entry errors, ensuring accurate tax calculations and reducing the risk of unexpected fines.

4. Enhanced Audit Trail:

E-invoicing provides a clear audit trail for all business transactions, making it easier for businesses to present the necessary documentation to the LHDN during audits, thus avoiding penalties related to incomplete or inaccurate records.

When selecting an e-invoicing solution, Malaysian SMEs should consider several important factors:

Features:

The e-invoicing solution should offer essential features like invoice creation, sending, tracking, and integration with accounting software.

Cost:

The cost of the e-invoicing solution should be affordable and fit within the business budget.

Scalability:

The solution should be scalable to accommodate business growth.

Security:

The solution must have robust security measures to protect sensitive financial data.

Support:

The vendor should provide excellent customer support to assist businesses with implementation and troubleshooting.

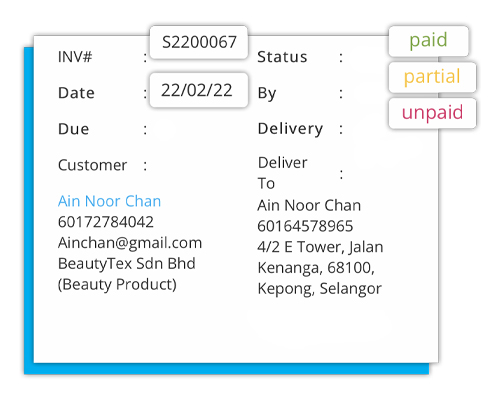

Niagawan is a cloud-based financial management system that offers comprehensive e-invoicing solutions for Malaysian SMEs. Key features of Niagawan's e-invoicing include:

1. Easy Invoice Creation:

Business owners can create invoices with just a few clicks.

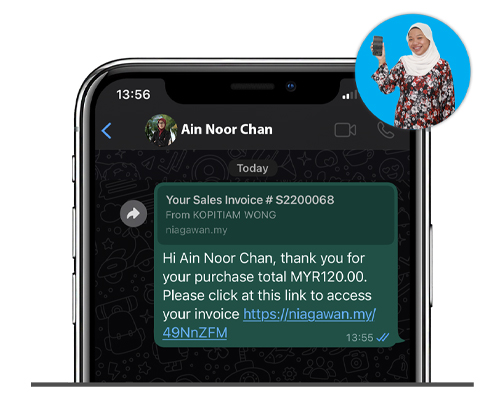

2. Electronic Invoice Delivery:

Invoices can be sent electronically via popular platforms like WhatsApp.

3. Real-Time Invoice Tracking:

Business owners can track the status of their invoices and follow up on outstanding payments promptly.

By utilizing Niagawan's accounting system, SMEs can streamline their invoicing processes, enhance accuracy, and reduce the risk of tax penalties.

E-invoicing is an invaluable tool for Malaysian SMEs looking to avoid tax penalties, increase efficiency, and improve their overall business operations.

By implementing e-invoicing, business owners can simplify their accounting processes, reduce errors, and enhance compliance with tax regulations. Niagawan offers a comprehensive e-invoicing solution that can help Malaysian SMEs achieve these goals effectively.