Managing finances for small and medium enterprises (SMEs) requires precision and a deep understanding, especially when preparing financial statements.

Mistakes in financial statements can not only misrepresent a business's performance but also lead to poor decisions that can ultimately result in losses. In this article, we will examine five common mistakes made by SME owners when preparing their financial statements and how to avoid them to ensure your business's stability and sustainability.

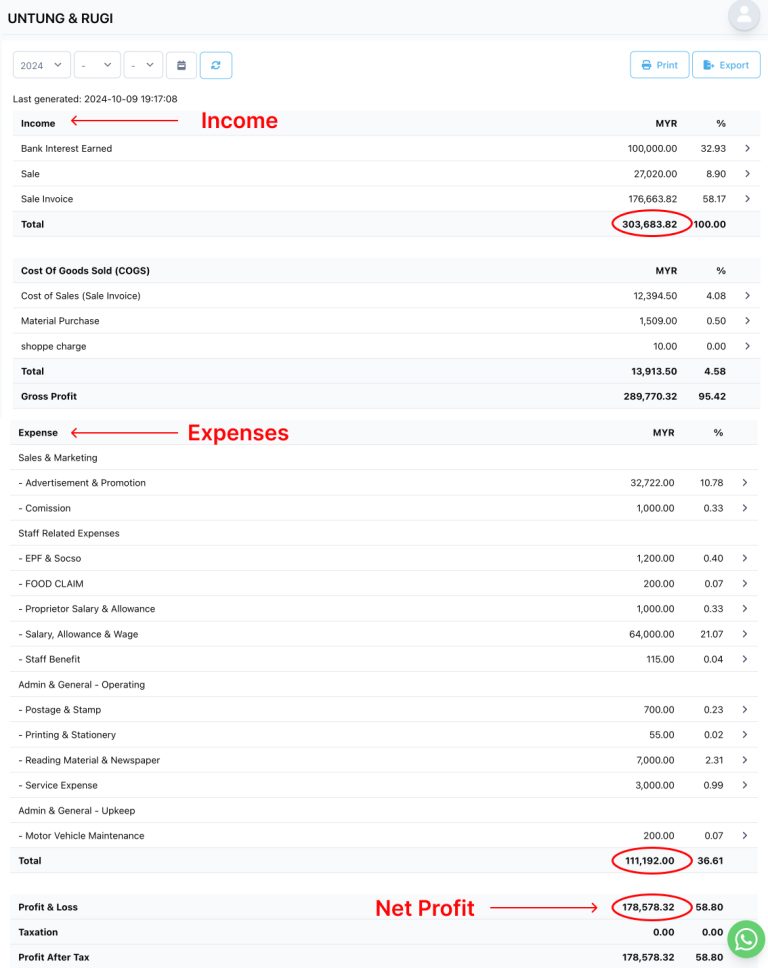

What is an Income Statement? An income statement is a document that records a business's revenues and expenses over a specific period, showing whether the business has made a profit or incurred a loss. This statement is crucial as it provides a clear picture of the business's performance.

Common Mistake: Many small business owners do not update their income statements regularly. They may only prepare it at the end of the year or whenever necessary, such as when dealing with tax authorities.

This leads to a lack of clarity regarding profits and operational costs during a specific period.

Why This Can Be Costly:If you don’t know how your business is performing over shorter periods, you may struggle to make important decisions, such as determining product pricing, investing in new inventory, or managing costs.

Without a regularly updated income statement, you could make decisions based on inaccurate information.

How to Avoid This Mistake: By spending time preparing monthly or quarterly income statements, you can gain a clear picture of your business's performance continuously. This allows you to make more accurate decisions based on current data.

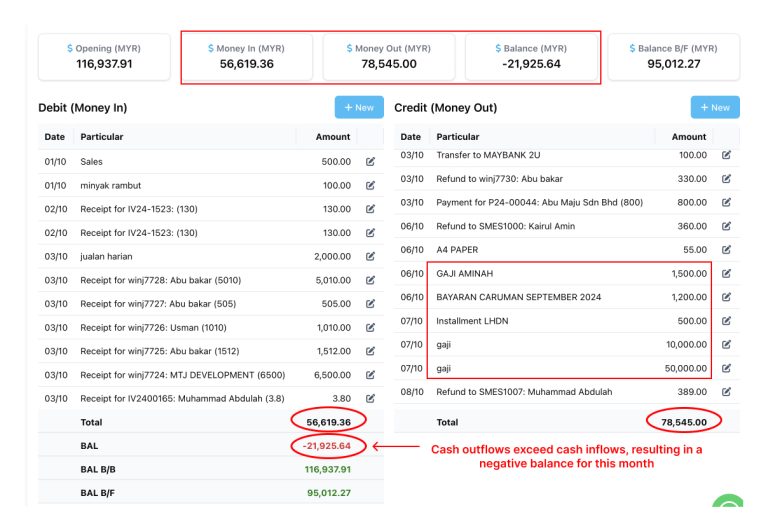

What is a Cash Flow Statement?

A cash flow statement displays the inflow and outflow of cash for your business over a specific period. This includes cash generated from operations, investments, and financing activities. This statement helps you understand how cash is utilized in the business.

Common Mistake: Many SME owners tend to focus more on profits but ignore cash flow. Even if a business appears profitable, without proper cash flow management, you might face issues such as a lack of cash to pay bills or employees.

Why This Can Be Costly: Neglecting cash flow can lead to unexpected cash flow problems that disrupt daily operations. For instance, even if you record profits, you might not have enough cash to meet obligations like supplier payments or employee wages.

How to Avoid This Mistake: By diligently monitoring cash flow and consistently preparing accurate cash flow statements, you can avoid unforeseen cash issues and ensure that your business runs smoothly.

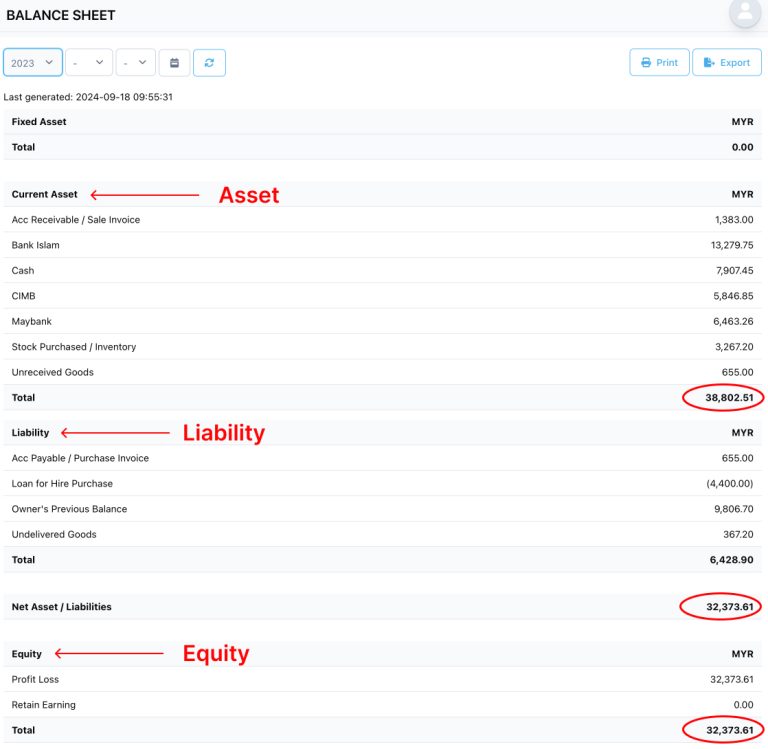

What is a Balance Sheet?

A balance sheet presents a snapshot of your business's assets, liabilities, and equity at a specific point in time. Assets include everything the business owns, while liabilities are obligations or debts that need to be settled.

Common Mistake: Many SME owners fail to separate current and long-term assets and liabilities in their financial statements. Current assets and liabilities refer to items that can be converted to cash or paid off within one year, while long-term assets and liabilities encompass periods longer than a year.

Why This Can Be Costly: When assets and liabilities are not properly classified, you may not have an accurate picture of your company’s financial position. This can lead to misconceptions about your business's financial capacity, especially when planning for long-term investments or financing.

How to Avoid This Mistake: Ensure that you correctly separate current and long-term assets and liabilities in your financial statements. This will help you see your business's true financial position and make more informed financial decisions.

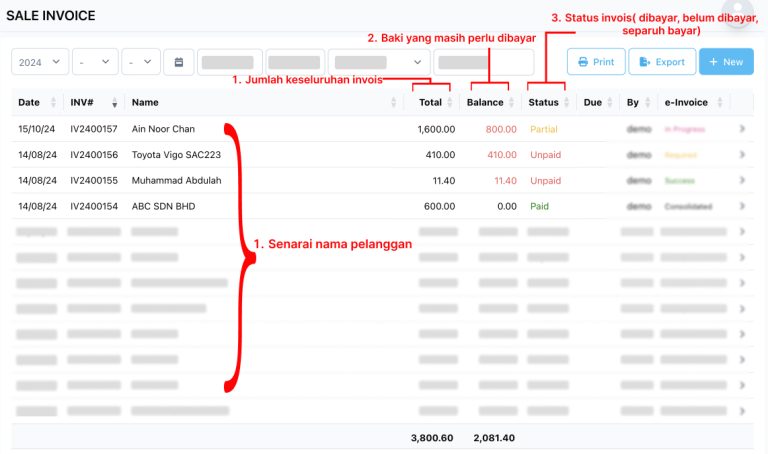

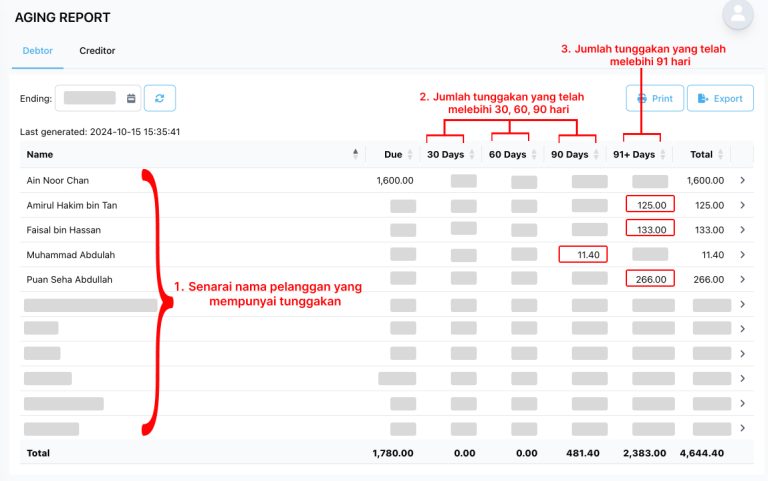

The Importance of Tracking Customer Receivables: Customer receivables (accounts receivable) represent the amounts owed to your business by customers. Properly managing receivables is crucial to maintaining stable cash flow for your business.

Common Mistake: Small business owners often fail to track customer receivables accurately, leading to overdue payments not being collected on time.

This usually happens when there is no effective management system to track who owes money and how long payments have been overdue.

Why This Can Be Costly:When overdue payments are not managed well, your business may face cash flow issues. This can impact your ability to meet financial commitments such as paying suppliers or employee salaries.

How to Avoid This Mistake: An effective customer receivable management system will help you track all overdue payments and take prompt action to ensure payments are received on time.

This way, you can maintain healthy cash flow and avoid financial troubles.

What is an Audit Report?

An audit report is a document that reviews the accuracy and validity of your financial statements. It is essential to ensure that all reported figures in your financial statements are correct and comply with accounting standards.

Common Mistake: Many SME owners tend to overlook the importance of audit reports, especially if their business is still small. They may not consider it necessary or feel it is too complicated to perform.

Why This Can Be Costly: Ignoring audit reports can lead to long-term financial issues. Small mistakes that go undetected in financial statements can result in tax problems, penalties, or even legal issues with authorities.

How to Avoid This Mistake: Conducting audits regularly ensures your financial statements are accurate and comply with regulations. This will help you avoid potential problems arising from inaccurate financial reporting.

Accurate and complete financial statements are key to your business's success. By understanding the five main mistakes commonly made by SME owners, you can take the necessary steps to ensure your financial statements are accurate and up-to-date. This will help you make better financial decisions and avoid issues that could jeopardize your business's continuity.

Continue to manage your finances diligently and ensure you regularly monitor your financial statements. This will help ensure your business stays on track and competitive in a challenging market.