Introduction

Managing finance effectively is crucial for success. Whether you are an SME business owner, a freelancer, or a self-employed professional, keeping track of income, expenses, and taxes can be overwhelming without the right tools. Accounting software simplifies financial tasks, reduces human errors, and provides real-time financial insights. It also simplifies bookkeeping and helps businesses maintain financial accuracy.

The problem is that not everyone knows about accounting software or knows it but doesn’t know how to use it. In this paragraph, I will describe who can benefit from using accounting software and which types of businesses can use it.

Who can benefit from using accounting software?

Small business owners who are currently starting a business

Since their labour force is limited, they can automate invoicing, quotation, payroll, and any other documentation.

Freelancer & self-employed professionals

These kinds of people are working by themselves. Accounting software can help their self-employed business to easily track income and expenses for tax filing and financial planning.

Medium and large enterprises

These businesses often have established processes and systems, and large enterprises have complex organizational structures. Some businesses have multiple branches to generate sales. Accounting software can help them conclude financial statements for their business.

In this blog, we will go through everything you need to know about accounting software so that you can choose a suitable accounting software for your business.

This blog including:

- Why accounting software is essential for business?

- Key features of accounting software

- Benefits of using accounting software for business

- How to choose the right accounting software for your business?

- Which type of business can use accounting software?

- Common challenges and mistakes when using accounting software

Why is Accounting Software Essential for Business?

Effective financial management is essential for businesses of all sizes, from a small business to large corporations.

Every business needs to manage finances efficiently to ensure that daily transactions are recorded accurately, cash flow is monitored, and expenses are controlled. Especially self-employed professionals, because they need to do everything in a lack of labour force. Without proper financial management, small businesses may struggle with budgeting, forecasting and sustaining profitability.

Medium and large businesses have more complex financial operations. They have multiple departments, locations, or even international operations. So they need to handle more data. Automation can help medium or large businesses automate repetitive tasks to save time and reduce errors. Tasks like invoicing, expense tracking or financial reporting could be automated.

Then, how were freelancers or self-employed professionals? Does their employment type need accounting software?

Of course, they must maintain meticulous financial records to simplify tax filing and ensure their income and expenses are well-documented.

How Accurate Accounting Impacts Decision-making and Growth

When a business needs to grow, their financial record must be accurate. When financial records are precise, business owners can plan company strategy for the future. Otherwise, it will result in poor financial decisions, tax compliance issues, and potential financial losses.

By maintaining accurate accounting records, businesses must investigate financial status such as revenue, expenses, operational cost, return on investment, etc.

This process can let business owners know how the company can accept the level of financial risk, which product/service requires a high profit margin, and future growth planning. Also, they can set business goals and identify areas that require improvement based on financial reports.

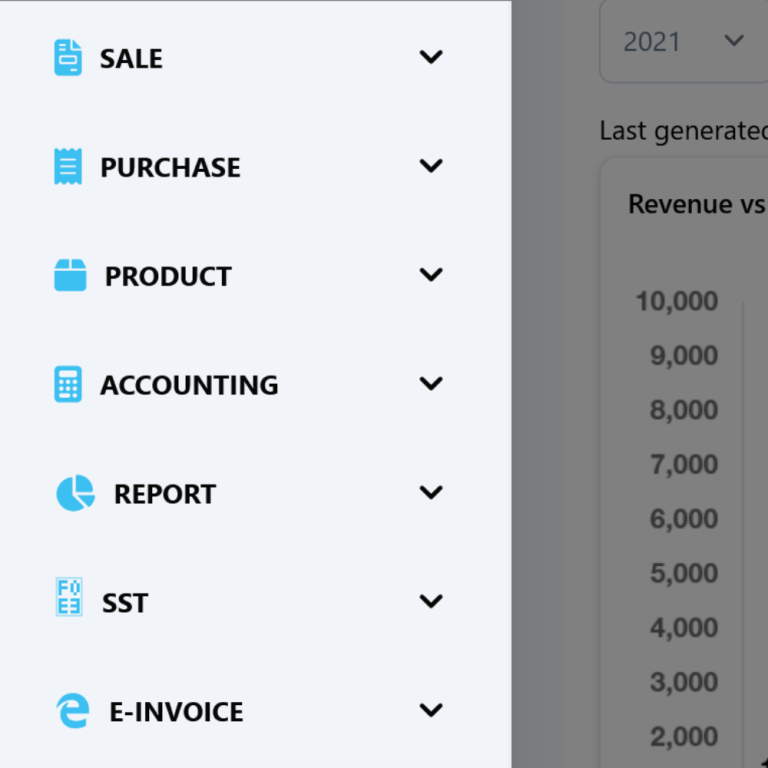

Key Features of Accounting Software

Bookkeeping Process

Bookkeeping is the foundation of accounting, and this is a must-have function in accounting software.

What’s inside the bookkeeping process?

Accounting software like NiagaPlus allows users to generate professional invoices and send invoices to customers. For example:

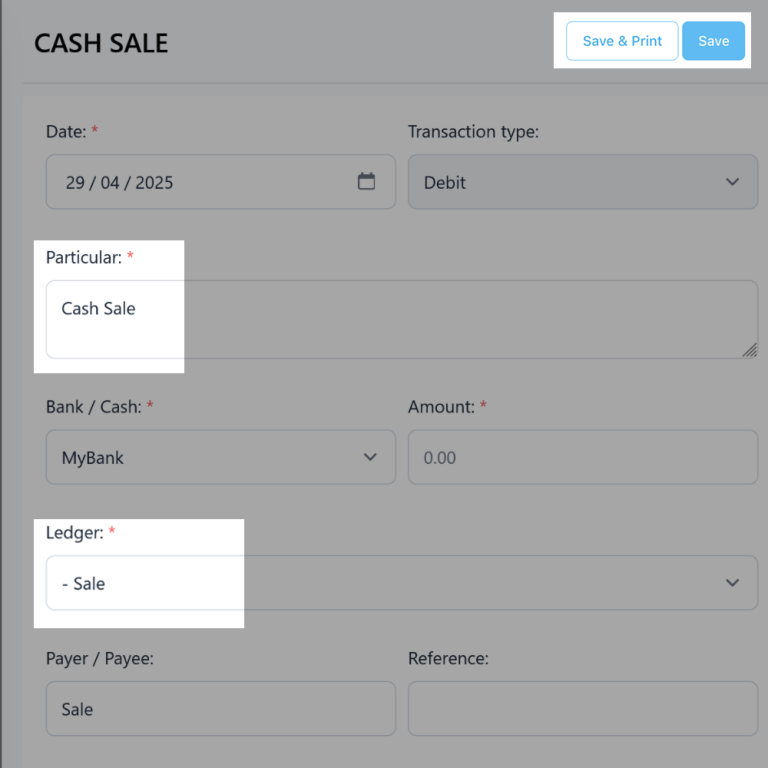

Users also can key in cash sales and print receipts.

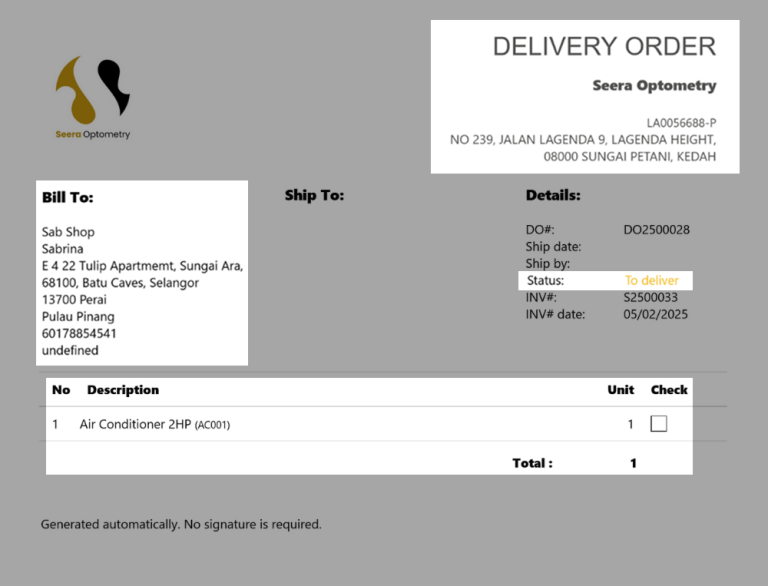

Accounting software also allows users to create delivery orders when they create sales invoices.

If the customer returns a product and they request a credit note or you are refunding goods and request a debit note, you can generate a credit/ debit note in the accounting software.

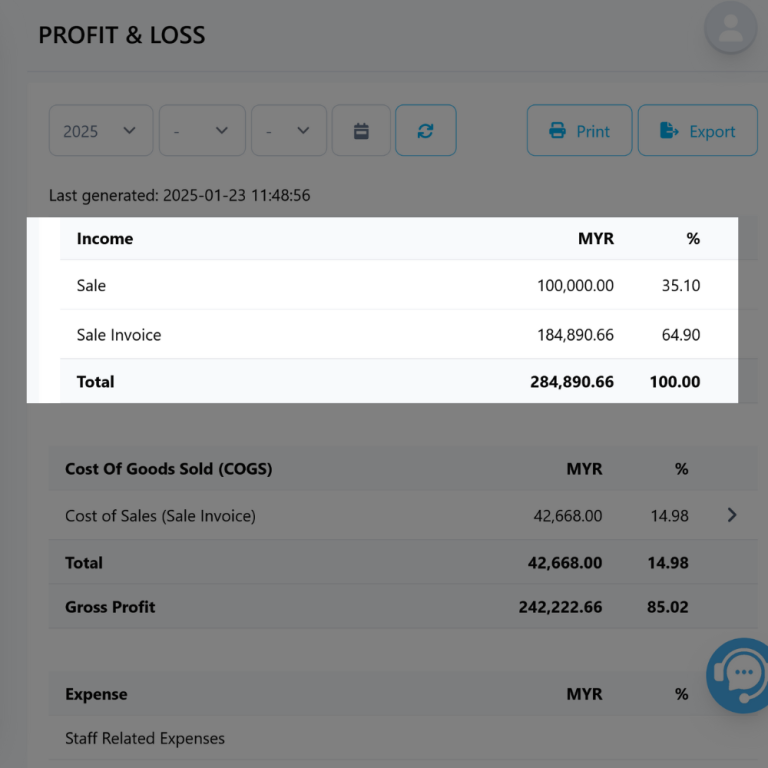

Financial Report

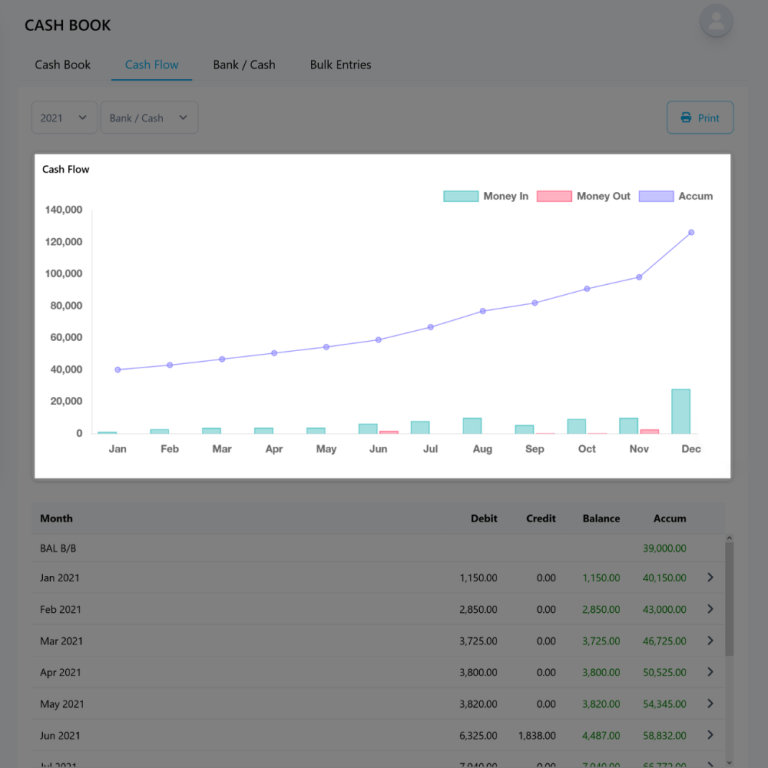

Financial report is essential for businesses to track their performance. It has included Balance Sheet, Income Statement and Cash Flow Statement.

Most accounting software provides automation to generate financial reports. But do you know how accounting software generates these?

First, you need to record all transactions in the bookkeeping process, as described above, including every sale, purchase, expense, etc. The accounting software will help you calculate the sales, expenses, receivables or payables, etc, to generate the financial reports.

Below are the financial reports that can be generated from most accounting software:

Tax Compliance and Calculations

One of the most important features of accounting software is its ability to handle tax compliance. In Malaysia, there are specific SST criteria (Sales & Service Tax). The businesses that meet the criteria are responsible for collecting the SST from consumers and remitting it to the Malaysian government.

For Sales Tax criteria:

When the sales of businesses exceed RM500,000 taxable goods/products in 12 months, they are required to register for sales tax.

For Service Tax criteria:

When businesses' sales exceed RM500,000 in taxable services in 12 months, they are required to register for service tax. However, there are different thresholds for specific industries; for example, restaurant operators at RM1,500,000 are required to register.

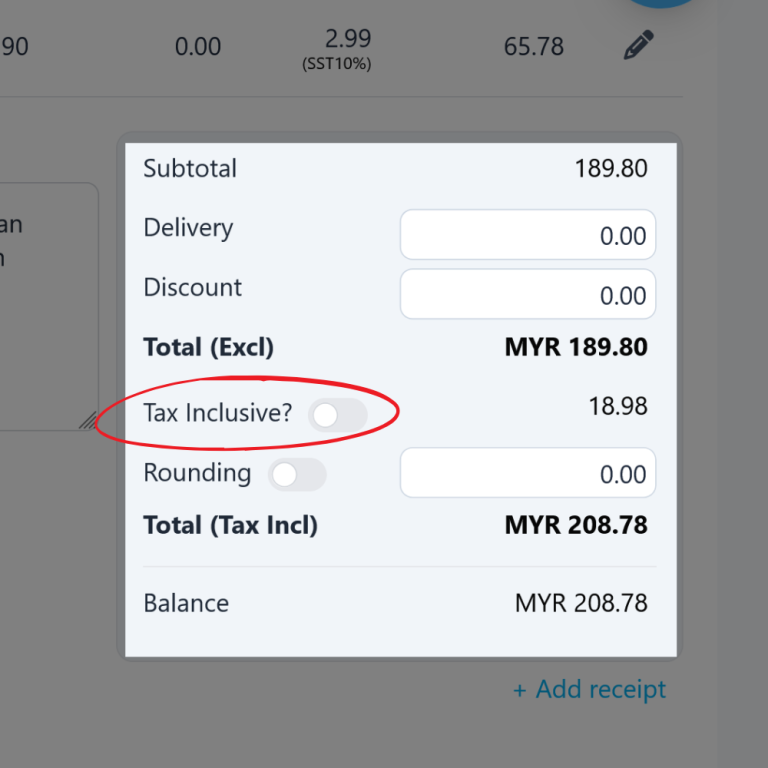

Do you know how accounting software helps you to calculate SST?

Accounting software allows you to set up the SST rate. So, when you record a sale, accounting software automatically calculates the SST amount into the bill based on the tax codes assigned to the item or service.

For example, the below image shows how NiagaPlus calculate the SST automatically during create an invoice:

You can click the ‘tax inclusive’ button if you decide to include tax in the actual price.

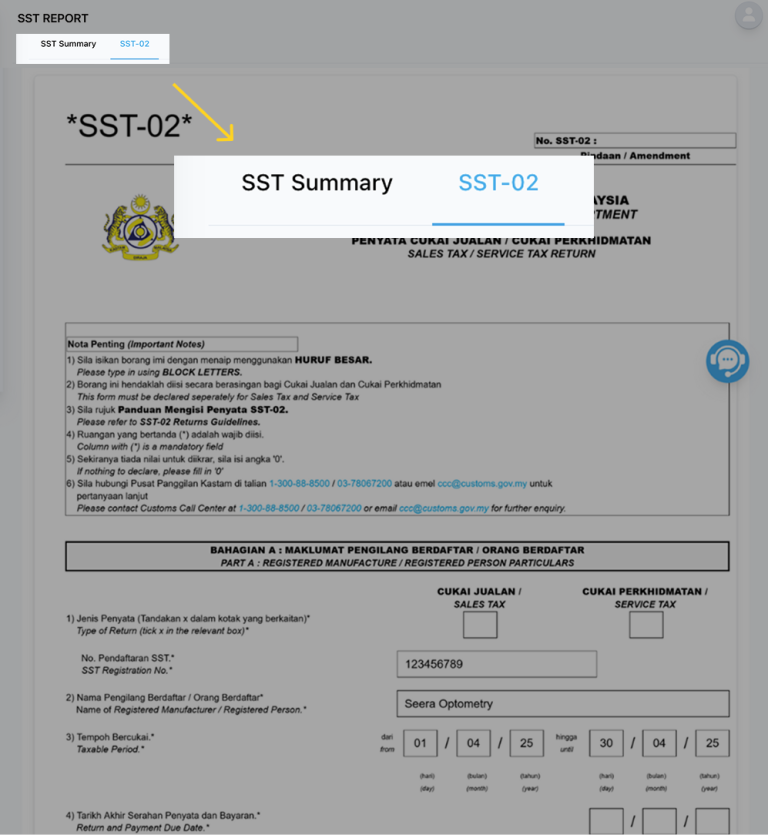

SST 02 Return Form

Some accounting software allows users to generate the SST02 form directly. It calculates the data needed automatically to increase work accuracy and save significant time to avoid manual processes.

Multi-user Access and Permissions

Some accounting software allows multiple users to access the same account. It is suitable for a business with more than one employee, such as a business owner, accountant, admin, or salesperson.

For example in NiagaPlus, the business owner can control the role of the staff and control which person can view or edit.

Benefits of Using Accounting Software for Business

If you decide to use accounting software in your company, it must have benefits. If not, why do you want to use it, right?

Cost-Effectiveness

One of the biggest advantages of using accounting software is that it helps save time with automated tasks. Imagine you or your admin/clerk are processing a bookkeeping task such as data entry; the task needs around hours to complete.

But if you have accounting software, you just need to key in and money out only, and the task can be done in a few minutes.

Accounting software also has other automated processes, as mentioned in the key features part, such as invoice generation, payment tracking, financial statement generation and others.

Improve Accuracy and Reduce Errors

As mentioned above, automated processes in accounting software can replace manual data entry, so it can reduce errors that may happen in manual processes, such as calculation mistakes, missing entries, or duplicated transactions.

For example, when you enter a purchase invoice, accounting software automatically updates expenses and accounts payable.

Real-Time Reporting & Forecasting

Accounting software gives business owners real-time financial data. Business owners can view their sales, expenses, cash flow, profit margins and other financial statements instantly.

Some accounting software like Niagaplus also provide dashboard graphs for the data, which help you monitor financial business and make informed decisions quickly.

How to Choose The Right Accounting Software for Your Business

Choosing the right accounting software for your business depends on your business size, industry and specific needs.

As a business owner, you can start analysing what your business hopes to get in an accounting system. Is it needed to track income and expenses? Or does your business need auto invoicing to speed up the process? Or is your business required to manage stock, so you need to manage inventory with product price?

Once you have identified your business’s needs, you can survey which accounting software offers features aligned with your business’s needs.

The Plan & Pricing

When choosing accounting software, budget is one of the most important considerations, especially for small business owners and startups. Understanding the pricing model can help you avoid unexpected costs and choose a solution that fits your needs both now and in the long run.

Subscription-Based Pricing (Monthly/Annually)

Most modern accounting software today operates on a subscription-based model. You pay a fixed monthly or annual fee to use the software.

This model is popular because it offers a lower upfront investment, making it easier for businesses to get started without committing to a large capital outlay.

Subscription plans usually come with automatic updates, meaning you’ll always have access to the latest features, including improvements, new tools, and tax compliance updates.

Since most of these platforms are cloud-based, you also gain the flexibility to access your account anytime, from anywhere, using any internet-connected device. Many subscriptions also include customer support and training as part of the package, which is beneficial for users who want continuous assistance.

One-Time Purchase (Lifetime License)

In contrast, some desktop-based accounting solutions offer a one-time purchase model. You pay a single fee up front and gain lifetime access to the software.

This can be more cost-effective in the long run, particularly for businesses that don’t need regular updates or cloud access.

However, there are some limitations. Most one-time license systems lack cloud access and are installed on a single device. Support is often limited to the first year, and any software updates or new features may require an additional fee.

As a result, the software may become outdated over time if you don't manually upgrade or repurchase new versions.

Choosing between subscription and one-time purchase depends on your business operations, preferences, and long-term growth. If you value convenience, regular updates, and remote accessibility, a subscription model will likely serve you best.

On the other hand, if your business runs primarily offline and you want to minimize recurring expenses, a one-time purchase could be the more practical option.

Some accounting software offer free access with limited function.To understand more about free vs paid accounting software solutions, can read the blog.

Ease of Use and Customer Support Availability

Beyond pricing, ease of use is one of the most important things to consider, especially if you don’t have a full accounting team behind you.

Many small business owners think, “I’m not a finance expert. I just need something I can figure out without getting stuck all the time.” When the software is complicated, it doesn’t just slow down your work—it chips away at your confidence.

That’s why solid, responsive support matters.

Let’s Imagine this scenario where your staff is trying to send out invoices during peak sales week. But the only person who understands the system is on emergency leave. You're left staring at the screen, unsure what to click—and there’s no one to ask. The clock is ticking, your customer is waiting, and your team is stuck.

This happens more often than people like to admit.

When you’re running a small business, every minute counts; delays in getting help can mean lost sales, missed deadlines, or even compliance issues.

Look for software that offers multiple support channels—live chat for instant help, email when it’s less urgent, phone calls for the big stuff, and a searchable help center for DIY moments. It’s not just about having support—it’s about feeling like someone’s there when you need them most.

Choosing accounting software that’s intuitive and backed by real human support isn’t a luxury—it’s peace of mind. Because when tech works for you, your business runs smoother, and you can focus on what really matters: growth.

Compliance with Tax Regulations and Audit Readiness

Let’s talk about something that often gets pushed aside—compliance. It’s one of those things you don’t think about until it becomes a real problem. If your software isn’t ready for SST or e-invoicing, you could be caught off guard—especially when your business suddenly takes off or new tax rules roll in.

Have you considered what might happen if your business starts growing faster than expected?

For instance, imagine a home-based food seller under the B40 group who begins getting more orders and eventually crosses the SST threshold.

Without a system that alerts and assists with SST setup, the business owner may unintentionally fall out of compliance, risking unexpected penalties.

Or imagine you’ve just landed a deal with a government-linked company or a big client who insists on receiving e-invoices. If your current system can’t handle bulk orders with e-Invoicing needed, that opportunity might slip right through your fingers.

Good accounting software should help you stay ahead of these moments. It should alert you, guide you through SST setup, and allow easy e-invoice submission to LHDN without MyInvois Portal. You don’t need to become a tax expert overnight—you just need the right tools backing you up.

So if you’ve ever thought, “But my business is still small, why should I worry about all this now?”,

How about if you are dealing with a big company one day? And they are requesting an e-Invoice from your company. But, they won’t deal with you if you can’t issue the e-Invoice because, from their angle, they are required to request the e-Invoice.

For a deeper explanation on how to stay compliant and automate tax processes, check out our dedicated post: ['How to Set Up SST and E-Invoice in Your Accounting System.']

By choosing a solution that stays aligned with current regulations, you’re not just checking a box—you’re building long-term peace of mind and reducing stress down the line.

Which type of Business Can Use Accounting Software?

Accounting software isn’t just for large corporations. No matter your business size or type, having the right tools to manage your finances makes a real difference. But a lot of people still ask themselves, “Is my business too small for this?”

If you’ve ever thought that, you’re not alone. Let’s break it down:

Small Business

If you're a small business owner, maybe you’re juggling everything yourself—handling sales, expenses, and inventory by hand or in a messy spreadsheet. It feels manageable now, but what happens when orders increase? Or when tax season hits?

Imagine a local Char Koay Teow seller recording every sale manually in a notebook. But with a simple mobile accounting app, they can just tap in each transaction and get daily profit reports instantly. No more guesswork. No more end-of-month panic. It helps them stay organized and make smarter decisions for growth.

The truth is, no business is too small for better tools, especially tools that save time and give clarity.

Medium and Large Business

As businesses grow, things don’t just get bigger—they get more complex. Maybe now you’re managing multiple outlets, different teams, or even multiple payment methods. And the old manual methods? They don’t cut it anymore.

Let’s say you’re running a furniture manufacturing company with operations in different states. You need to track stock levels at each warehouse, manage invoices from multiple suppliers, and generate SST-ready tax reports. That’s a lot to handle.

Without a centralized system, things slip through the cracks. But with the right accounting software, everything’s connected, automated, and audit-ready. It doesn’t just reduce errors—it saves your sanity.

Whether you’re running a roadside stall or a regional business, the right accounting software helps you move forward with less stress and more control.

Freelancers or Self-Employed Professionals

As a freelancer or self-employed worker, you wear many hats—creator, marketer, manager, and accountant. Your income isn’t always steady. Clients pay late. Projects overlap. It can feel chaotic.

Picture a freelance graphic designer trying to juggle five clients from three different companies. They have to send invoices in different time frames, track who has paid what, and still keep receipts for tax season. Without help, it’s a mess.

But with the right accounting software, they can issue customized invoices anytime, view the aging report, and organize all expenses in one place. When tax season comes, they’re not scrambling—they’re prepared.

The peace of mind that comes from financial clarity isn’t just for big companies. It’s for anyone who wants to stop stressing and start focusing on their craft.

Some of you might be asking, can you use accounting software if you have no accounting background?

Common Challenges and Mistakes When Using Accounting Software

While accounting software offers immense benefits, the transition isn’t always smooth—and that’s where many business owners begin to feel the weight of uncertainty.

Have you ever delayed moving away from your manual record book because "it's still working fine"? Or thought, "We'll figure it out as we go" when purchasing new software? These small decisions often snowball into bigger complications during implementation.

Don’t Let Old Data Stop New Growth

One of the most underestimated and emotionally taxing hurdles is data migration. On the surface, it may seem straightforward—just move your records from spreadsheets or notebooks into a digital system.

But for many business owners, this is where years of messy bookkeeping, emotional attachments to old methods, and fear of losing control all collide.

And let’s be honest—many businesses delay the transition simply because they’re afraid of what they’ll find. “What if we migrate the wrong data and mess everything up?” “What if the system doesn't understand how we do things?” These are real concerns that go beyond logic.

Yet ironically, this very fear is what holds businesses back from fixing what’s broken. The longer you stay with unstructured, inconsistent records, the harder it becomes to scale, delegate, or make confident financial decisions.

What if, instead of fearing the mess, you saw this transition as a chance to clean house, gain clarity, and start fresh—with better tools and fewer headaches?

Maybe your records aren’t perfectly organized, and that’s okay. Most businesses start there. What matters is that migrating to accounting software gives you a fresh opportunity to clean up the past, standardize your data, and gain better clarity moving forward. You’ll finally move from “guesstimates” to real insights that can help you make smarter decisions every day.

That’s why proper preparation is key. Before migrating anything, take the time to audit your existing records. Clean them up. Standardize them. Don’t rush into it. If needed, work with an expert or ask your software provider whether they offer migration support. A good provider will help you create a checklist, validate your data, and guide you through the process step by step.

Winning Over the Skeptics

Team resistance isn’t just about being “stubborn” or “unwilling to learn”—it’s about fear, insecurity, and self-doubt hiding behind familiar routines. In many traditional or family-run businesses, staff have relied on the same manual methods for years, sometimes decades.

You might hear them say, “Why fix what isn’t broken?” Or they’ll joke, “I’m too old for this tech stuff,” masking a very real anxiety: “What if we click the wrong thing and lose everything?” They worry they’ll click the wrong thing, delete the wrong file, or that they’ll feel foolish for asking “simple” questions. But this fear isn’t a dead end—it’s a starting point for growth.

The truth is, people don’t resist change—they resist uncertainty and feeling left behind.

That’s why early involvement matters. Invite your team to be part of the software selection process. Ask them: “What do you need help with every day?” “What slows you down the most?” When they feel heard, they feel valued—and when they feel valued, they become open to change.

With the right guidance and empathy, even the most hesitant team member can become a confident user—and sometimes, your biggest champion for change.

The Myth of “We’ll Just Figure It Out”

One of the most overlooked parts of implementing accounting software is proper training. A lot of business owners fall into the trap of assuming, “It’s just software—it can’t be that hard,” or “We’ll learn as we go.” On the surface, this mindset seems practical. After all, why waste time on structured training when you’re already busy running a business?

But here’s the reality: what feels like a shortcut often turns into costly delays down the line.

Think about it—have you ever bought a tool, didn’t fully learn how to use it, and ended up only using 20% of what it could do?

This is a real example of our customers where a user didn’t know how to properly manage the customer database in their new accounting system. As a result, they accidentally added the same customer multiple times every time there was a purchase—creating duplicates and making it impossible to track the customer's total spending over time.

That’s exactly what happens with accounting systems when teams aren’t trained. They only scratch the surface—missing out on features that could automate work, speed up reporting, or reduce costly mistakes.

This type of error often stems not from carelessness but from a lack of proper onboarding or training. Most probably had the assumption that only one person (usually the admin or finance lead) needs to know how to use the system. But what happens when that one person is on leave? Or decides to leave the company altogether?

The good news? With a bit of patience and guidance, these issues are absolutely solvable. Many modern providers offer onboarding, quick-start tutorials, live webinars, and friendly support teams to walk you through anything tricky.

It Worked for Them… But Will It Work for You?

Another mistake many businesses fall into? Choosing software just because “everyone else is using it.”

It’s understandable—when you're overwhelmed with options and a peer or friend swears by a particular system, it feels safer to follow their lead. You think, “If it’s good enough for them, it should work for me too, right?”

But here’s the thing: no two businesses are exactly alike. A retail shop might recommend a system that tracks physical inventory beautifully—but what if your business is service-based or operates online? “If it’s good enough for them, it should work for me too, right?” mindset often leads to mismatches between software capabilities and your actual needs.

For example, a friend running a café might rave about their POS system—and while it works great for quick sales and receipt printing, it may not offer detailed financial reports, expense tracking, or SST-ready invoicing.

On the other hand, a full-set accounting system can handle everything from bank reconciliation and inventory tracking to tax submission and customer insights—but may not have the real-time cashier features you need if you run a walk-in retail store.

Emotionally, this decision is often fueled by fear of choosing the "wrong" software, or the anxiety of having to figure it all out alone. It’s easier to go with what’s familiar, or what someone else has “proven” works. But that shortcut can cost you time and money down the line—especially when you realize it doesn’t actually meet your business needs.

When ‘Later’ Becomes Too Late

Let’s face it—when everything seems to be working fine, system maintenance often slips to the bottom of the to-do list. Business owners are busy. There’s stock to manage, customers to serve, cash flow to monitor. So when a pop-up says, “Update available,” it’s easy to think, “Not now, maybe later.” And that “later” stretches into months.

But here's what many don't realize: those small updates often contain critical improvements—bug fixes, SST adjustments, enhanced backups, or new security protocols. Skipping them can mean inaccurate tax calculations, lost data, or even leaving your business vulnerable to security breaches. Imagine trying to submit your e-Invoice only to discover your system isn’t compatible with the latest LHDN requirement.

Best Practices to Help You Get It Right (Without Losing Sleep)

Let’s face it—adopting new systems can feel like you’re suddenly expected to be an IT expert overnight. But it doesn’t have to be that way.

If you’ve been nodding along to any of the challenges we talked about earlier, just know—you’re not alone. Every business owner has been there, and there are simple ways to make the journey smoother.

Involve Your Team Early – Because This Isn’t Just Your Journey

When you’re running a business, it’s easy to feel like the tech decisions are solely on your shoulders. But the truth is, your team will be the ones using the system day in and day out—so bringing them in early isn’t just helpful, it’s essential.

Think about it: when people are handed a new system without warning or input, it often feels like change is being forced on them. That’s when fear creeps in—“Will this make my job harder?”

But when they’re part of the decision-making from the start, the emotion shifts from fear to ownership. Instead of resisting the system, they help build it. Instead of dreading change, they start asking, “What else can this do?”

Involving your team can be as simple as asking for feedback during demo sessions, or letting them test features before finalizing the decision.

You’ll discover hidden insights too—like that your cashier needs a faster way to search repeat customers, or that your sales team values customer spending reports. These real-world needs often don’t show up in software brochures—but they come up quickly in honest team conversations.

Break Training into Bite-Size Pieces — So No One Feels Left Behind

In reality, most people won’t say out loud that they’re struggling—they’ll just avoid using the system or make mistakes without realizing it.

It’s not because they’re careless—it’s because learning a whole new workflow can be intimidating. Especially if someone hasn’t had much exposure to tech tools. Imagine a team member who’s great at handling customers and paperwork—but suddenly they’re asked to manage inventory, create invoices, and run reports inside a software they barely understand.

So here’s the better way forward: don’t throw everything at your team in one go. Start with just the basics—like how to create a sales invoice or check customer history. Use screenshots, short videos, or even step-by-step WhatsApp messages. Focus on one small win per week.

Over time, the confidence builds naturally—and soon enough, your staff will be teaching others.

When people feel supported instead of judged, learning becomes less about pressure and more about progress.

Test First, Buy Later

Let’s be real—choosing software can feel like buying a car without a test drive. Most business owners don’t have time to read every feature list or compare every plan. So, it’s totally understandable that many lean on recommendations: “My friend uses this one for her salon—it should work for my café too, right?”

The intention is practical: they want to save time, avoid analysis paralysis, and go with something proven. That’s why the best move is to test first—without pressure. Use trial periods. Book a free demo. Ask real questions: “Can this system grow with my business?” “Does my team feel confident using it?” “Does this give me better clarity, or just more steps?”

Trying before buying isn’t hesitation—it’s smart decision-making.

Choose Support That Talks Like You

Ever tried asking a question and got back a cold, robotic response that only left you more confused? Or worse—sent a support ticket and waited days for a reply that didn’t even solve the issue?

When something breaks down or when you're stuck in the middle of submitting SST, you don't want someone to send you a link to a 50-page manual. You want a real person, someone who understands your local business challenges, speaks your language (literally and emotionally), and gives you the right answer—fast.

This is where the “people behind the system” matter most.

Many businesses underestimate the importance of support when choosing software. They focus on features, price, or popularity—but forget that the system is only as good as the help you can get when things go wrong. It's not just about whether the system works. It's about how easily you can get help when it doesn’t.

That’s why choosing a provider with responsive, local, and empathetic support is a game-changer. They won’t just fix the issue—they’ll explain it in a way that helps you feel more confident using the system on your own next time.

Pro tip: Before committing to a software, test their support during the trial period. Call them. Email them. Ask a weird question. See how fast and friendly the response is. That tells you more than a feature list ever will.

Make Maintenance Part of the Routine

Most of us don’t develop the habit of feeling the need to run software updates every time it is available. But just like skipping a car service, the longer you delay, the higher the risk of a breakdown at the worst possible moment.

So why do we put it off?

Because updates feel technical. Time-consuming. Risky, even. You might worry, “What if this version breaks after the update?” or “I’ll do it later when I’m less busy.”

For small business owners juggling ten things at once, system upkeep simply falls to the bottom of the to-do list.

But here’s the thing—most modern software updates are smoother than ever. They fix small bugs, improve security, and often unlock helpful features you didn’t even know you needed. One skipped update might not hurt.

But five? Suddenly you’re running outdated tax rates, missing new automation tools, or exposing your data to security risks.

💡 Best practice: Set a fixed day each month—maybe the first Monday or last Friday—and dedicate just 30 minutes to check for updates, back up your data, and test critical features. Make it a routine, like balancing your cash drawer or checking stock levels.

Some businesses even assign this task to a specific team member or set reminders in their calendar.

Think of it as giving your system a health check. It's a small effort now for peace of mind later.

Conclusion: It’s Okay to Start Small

We get it—running a business is already a handful. Adding “learn accounting software” to the mix can feel like one more thing on a never-ending to-do list. But here’s the truth: you don’t have to be perfect or tech-savvy to start. You just have to take that first small step.

Maybe you’ve been relying on manual ledgers, Excel sheets, or mental notes for years—and they’ve served you well. But deep down, you probably know there’s a better way. A way that doesn’t leave you scrambling at tax time, worrying about missing invoices, or losing sleep over mismatched numbers.

And the best part? You don’t have to do it alone. With the right system, you’ll get support, guidance, and tools that grow with you. You’ll spend less time buried in paperwork—and more time doing what you love.

So take a deep breath. You’re not behind. You’re right on time. Your business deserves systems that support your ambition, not slow it down.