As a business owner, understanding cash flow and profit is crucial to ensuring the success of your business. These two concepts might seem similar, but in reality, they have significant differences and can greatly impact your business.

In this article, we'll explore the differences between cash flow and profit, effective ways to manage both, and strategies you can use to keep your business finances stable.

Cash flow refers to the movement of money in and out of your business. This includes cash you receive from sales and cash you spend to cover operational costs.

A healthy cash flow ensures you have enough money to cover daily expenses, such as employee salaries, rent, and other expenses.

Importance of Monitoring Cash Flow:

1. Determine Business Liquidity: Positive cash flow means your business can cover all expenses without needing additional loans.

2. Prevent Short-Term Financial Issues:

Even if a business is profitable, lack of cash flow can lead to issues with paying bills, salaries, or restocking inventory.

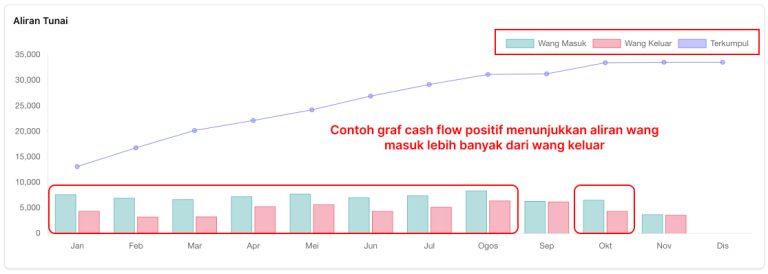

Positive Cash Flow

This happens when the amount of cash entering your business is greater than the amount going out. Positive cash flow indicates that your business has sufficient financial resources to cover operational costs, fund growth, and handle any financial emergencies.

Negative Cash Flow

Conversely, negative cash flow occurs when more cash is going out than coming in. This can signal a problem, as it suggests your business may not have enough cash to cover expenses.

Even if your business is profitable, negative cash flow may force you to seek loans or cut costs to avoid financial difficulties.

Profit is the amount left after deducting all costs from business revenue. It gives you a true picture of your business’s viability. There are two types of profit:

1. Gross Profit:

Revenue after deducting direct sales costs (like raw materials or goods sold).

2. Net Profit: The amount left after all operating costs are deducted, including wages, rent, and taxes.

Monitoring profit helps measure business success and long-term planning, enabling you to plan new investments, business expansion, or other strategies to improve competitiveness.

The difference between cash flow and profit may seem minor, but it can have a significant impact on your business:

1. Cash Flow Is Real-Time:

The funds you currently have available for use.

2. Profit Is on Paper:

The amount you earn after deducting costs, but it doesn’t mean cash is readily available.

For example, if you have customers who are slow to pay, your profit may show business success, but your cash flow will be affected because funds aren’t received promptly.

Monitor Daily or Weekly Cash Flow:

Don’t wait until the end of the month to review finances. Use financial management software like Niagawan or NiagaPlus to help you track cash flow.

Offer Discounts for Early Payments:

You can offer discounts to customers who pay by cash or debit card. This speeds up your cash flow and reduces issues with delayed payments.

Reduce Fixed Costs:

Reevaluate your operating costs, such as rent, utilities, or subscriptions. Cut down wherever possible to increase cash flow.

1. Focusing Too Much on Profit Without Monitoring Cash Flow:

Many business owners get caught up in profit numbers and forget to monitor cash flow, which can lead to issues when it's time to pay salaries or rent.

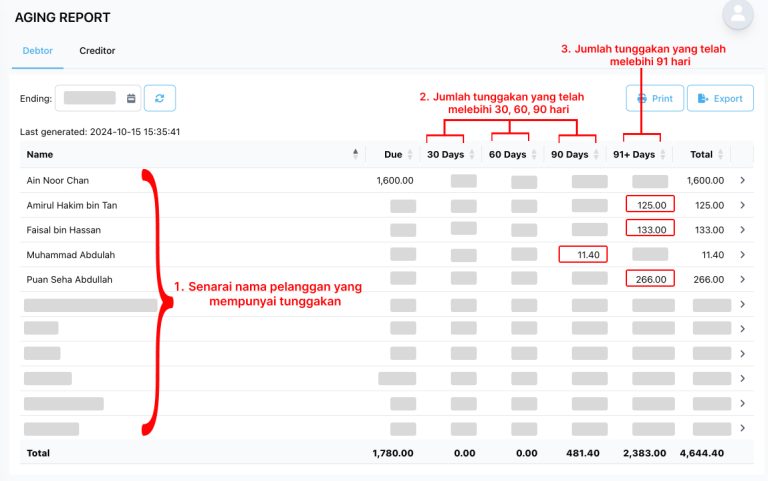

For instance, if a store owner doesn’t realize many customers have unpaid debts, they might not have enough cash to cover monthly expenses.

2. Inefficient Billing:

Properly managing invoices and billing is critical. When invoices aren’t sent promptly or customers aren’t reminded about overdue payments, cash flow can be affected. Business owners often assume customers will pay automatically, but reminders are often necessary.

3. Neglecting Cash Flow Planning:

Without good planning, it’s challenging to forecast future financial needs. Business owners should take time to plan monthly cash flow, including income and expense projections. This helps avoid cash shortages that could disrupt operations.

1. Regular Monitoring

Track your cash flow and profit regularly. Use software like NiagaPlus to get clear and accurate financial reports.

2. Timely Invoicing

Ensure invoices are sent promptly and follow up with reminders for unpaid customers. This helps improve cash flow.

3. Good Financial Planning

Spend time planning your cash flow. Create budgets and forecasts to understand future financial needs.

4. Effective Debt Management

If your business offers credit to customers, manage debt well. Track payments and reach out to customers if payments are late.

Understanding the difference between cash flow and profit is a critical step in managing your business finances. With smart management, you can ensure your business is not only profitable but also has a healthy cash flow.

Using the right tools and strategies will simplify financial management and help maintain business continuity.