In business, effective financial management is crucial to the success of any company. For many entrepreneurs, handling financial records can often seem like a challenge requiring expertise.

However, by understanding the basics of financial records and using modern technology such as cloud accounting systems, financial management becomes simpler, more accurate, and efficient.

This article will provide a complete guide to help you understand how to manage your business's financial records more effectively.

Financial records refer to all documents that record a company's financial activities, including cash inflows and outflows, debts, payments, investments, and more.

Examples of financial records include bank statements, invoices, receipts, and monthly financial statements.

Accurate and organized financial records are crucial to ensuring that your business's cash flow remains healthy. It also helps you monitor business performance, manage taxes properly, and ensure compliance with legal regulations.

Additionally, good financial records provide a clearer picture of the company's financial situation. They allow entrepreneurs to make more informed strategic decisions, such as reducing unnecessary expenses or increasing investments in profitable areas.

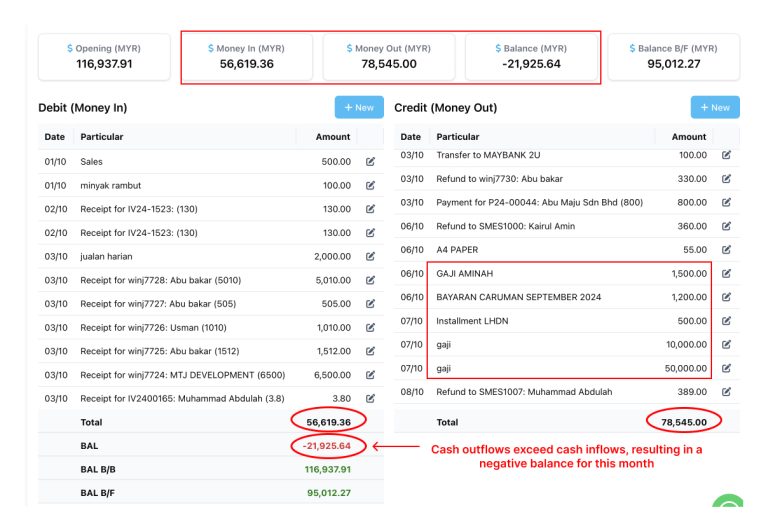

By keeping accurate financial records, you can monitor cash flow more clearly. This includes ensuring that all expenses and revenues are recorded correctly.

A good record system will help you determine whether your business is in good financial health or requires improvement.

One of the main challenges for entrepreneurs is the inability to manage cash effectively. Well-organized financial records will help you identify any problems in cash flow, such as overdue payments or excessive expenses. With clear records, you can act quickly to resolve these issues.

Stakeholders such as investors, banks, and tax authorities need access to transparent and organized financial records. Having good financial records increases your business's credibility, making it easier to obtain loans, investments, or other financial support.

To start managing your business's financial records, you need to understand the types of documents that should be recorded. Some of the records you need to keep are:

- Sales and purchase invoices: To ensure that every transaction is clearly recorded.

- Bank statements: To verify cash inflows and outflows.

- Profit and loss reports: This is one of the key financial statements that shows the company’s financial position at any given time.

In today's digital world, there are many accounting systems that can help you manage financial records. Systems like NiagaPlus offer cloud accounting solutions designed for small and medium-sized businesses. They allow you to record transactions, generate financial reports, and manage inventory more easily.

Monthly financial statements are essential tools that help you understand your business's financial performance over a specific period. There are a few basic steps to preparing accurate monthly financial statements:

- Gather all financial records: Ensure you have all relevant invoices, receipts, and bank statements.

- Categorize expenses and income: Break down each transaction into appropriate categories, such as sales, marketing expenses, or the cost of goods sold.

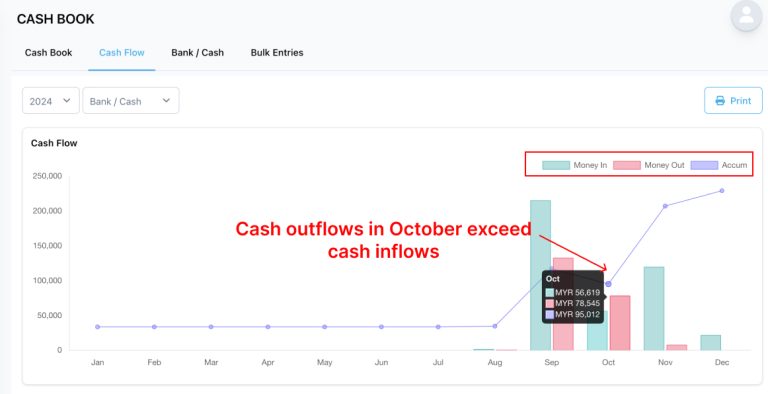

- Perform a cash flow analysis: A cash flow statement allows you to see whether your business is generating more money than it is spending.

Monitoring cash flow is one of the most important aspects of running a business. Make sure you regularly check your cash flow statement to ensure that expenses do not exceed revenue. You can also use this data to identify areas where costs can be reduced.

One of the common mistakes made by entrepreneurs is not recording all transactions. This includes small transactions that may seem insignificant. However, incomplete financial records can lead to errors in financial statements and tax filings.

Good organization is key to successful financial management. Ensure that all financial documents are well-organized and easily accessible. Using digital accounting systems can help organize documents more efficiently.

Failure to report taxes correctly can result in hefty penalties. Ensure that all your financial records are accurate and comply with applicable tax laws. This includes ensuring you have all necessary documents, such as invoices and bank statements.

Proper financial record management helps create long-term financial stability. By knowing where you can cut costs or increase revenue, you can plan for sustainable business growth.

Entrepreneurs with good financial records have a higher chance of obtaining loans or investments. This is because banks and investors want to see evidence that your business has a healthy cash flow and is well-managed.

Audits are an important part of the business process. With well-organized financial records, you can face audits with more confidence and without issues. This also reduces the risk of being fined by authorities for non-compliance with financial regulations.

Managing financial records is a crucial aspect of ensuring business continuity and success. By following the steps discussed, you can improve the accuracy and efficiency of your business’s financial management.

Accounting systems like NiagaPlus make this process easier, ensuring every transaction is recorded correctly and financial statements can be quickly generated. Therefore, always keep your business's financial records up-to-date to ensure they are always in good shape.