As a small business owner, ensuring that all sales transactions are recorded in an organized manner helps you understand cash flow, plan for taxes, and take strategic steps for business growth.

To ensure that you record sales properly, follow these steps, which will help make the process more efficient and accurate:

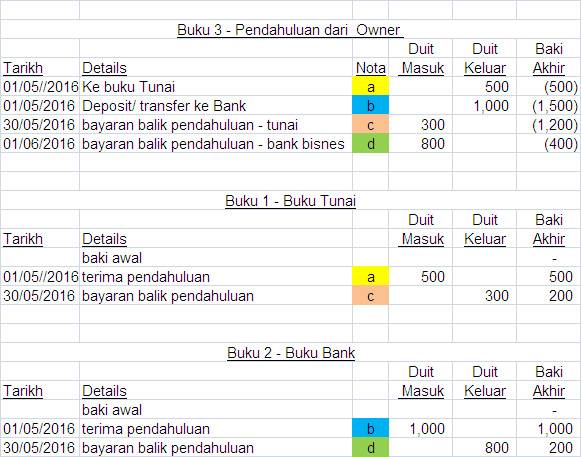

You can choose to record sales manually or use digital tools. Manual recording may be suitable for small businesses that are just starting out, but it is prone to human errors and time-consuming.

A good sales record should include the following details:

Recording sales regularly, such as daily or weekly, ensures that your data is always up-to-date. This helps assess daily performance and allows for adjustments to market changes or business operations.

There are many tools and applications that can help small businesses easily record sales. Below are some top recommendations suitable for the Malaysian market:

Free software like Excel can be useful in the early stages, but as your business grows, it may no longer suffice for maintaining complex records.

Software like NiagaPos and NiagaPlus from Niagawan offers additional features such as automated e-invoicing, detailed reporting, and inventory management, making the process of recording sales more accurate and automated.

Using a digital system like Niagawan offers several advantages:

- Automation: The process of recording sales and generating reports can be done automatically without manual input.

- Accuracy: Reduces the risk of human error in recording information.

- Ease of Access: Can be accessed anytime and anywhere, offering flexibility to busy business owners.

For small businesses, NiagaPos is the ideal choice as it is designed specifically for SMEs in Malaysia. It offers functions like recording sales, invoicing, and generating complete financial statements, making financial management easier.

Meanwhile, NiagaPlus provides more detailed features suited for larger businesses.

Recording sales may seem simple, but there are common mistakes that small business owners often make. Here's how to avoid them:

- Not Keeping Complete Records: Many entrepreneurs only record large sales but neglect small sales, which can affect financial reports.

- Delays in Recording Sales: Postponing the process of recording sales can lead to incorrect data entry and create confusion.

- Not Using the Right System: Using a system that doesn’t align with the business’s needs can result in incomplete or inaccurate data.

- Record Every Sale: Even if it seems insignificant, every transaction must be recorded for financial accuracy.

- Record Sales Regularly: Don’t wait until the end of the month to record sales. Do it daily or weekly.

- Use the Right Tools: Choose software like NiagaPlus or NiagaPos that can help reduce errors and ensure that records are always complete and accurate.

Recording sales isn't just about knowing how much you've sold; it's also about how it can help you plan for the future of your business.

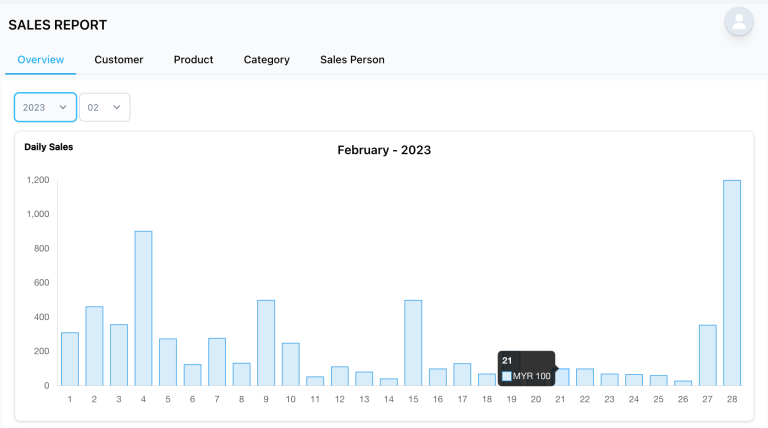

Accurate sales records allow you to identify sales patterns and measure the performance of specific products or services. This gives you a clearer picture of which areas need improvement or which are more profitable.

With well-organized records, you can perform an analysis to see sales trends. For example, if sales peak in a particular month, you can plan a better marketing strategy for that month in the following year.

NiagaPlus provides detailed reports that make it easy to conduct such analyses and forecasts.

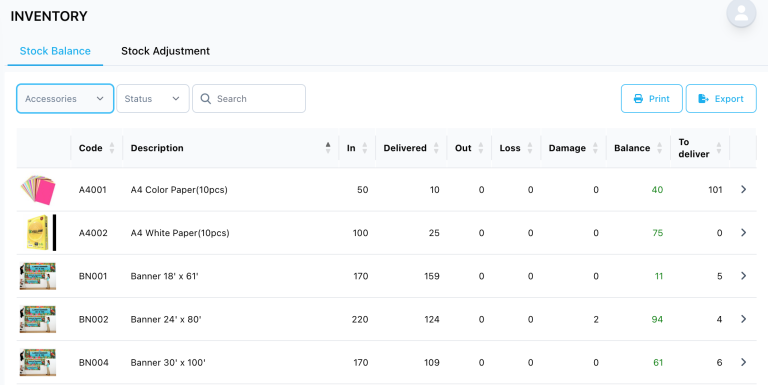

Another key benefit of accurate sales records is better inventory management. With a digital system, you can view inventory in real-time and avoid over-purchasing. This helps reduce waste and ensures that stock is always sufficient for business needs.

Niagawan is a financial management platform specifically designed for SMEs in Malaysia, and it offers various tools to make the sales recording process easier.

Niagawan is designed to be user-friendly, even for those with limited technical skills. With a simple interface and streamlined processes, business owners can record sales, generate invoices, and monitor their finances without hassle.

With NiagaPlus, business owners can access detailed financial reports, including financial statements, bank reconciliations, and sales analysis. The automation feature helps reduce the workload, allowing you to focus on other aspects of the business.

Properly recording sales is the foundation of small business success. It not only helps in making better decisions but also gives you an advantage in planning for business growth and expansion. With the right tools like NiagaPos and NiagaPlus, financial and sales management becomes easier and more efficient.

Start by ensuring that every sale is recorded in an organized and accurate manner, and you'll see how good sales records can take your business to the next level.